Diverse Savers United by Their Commitment to Cash Isas

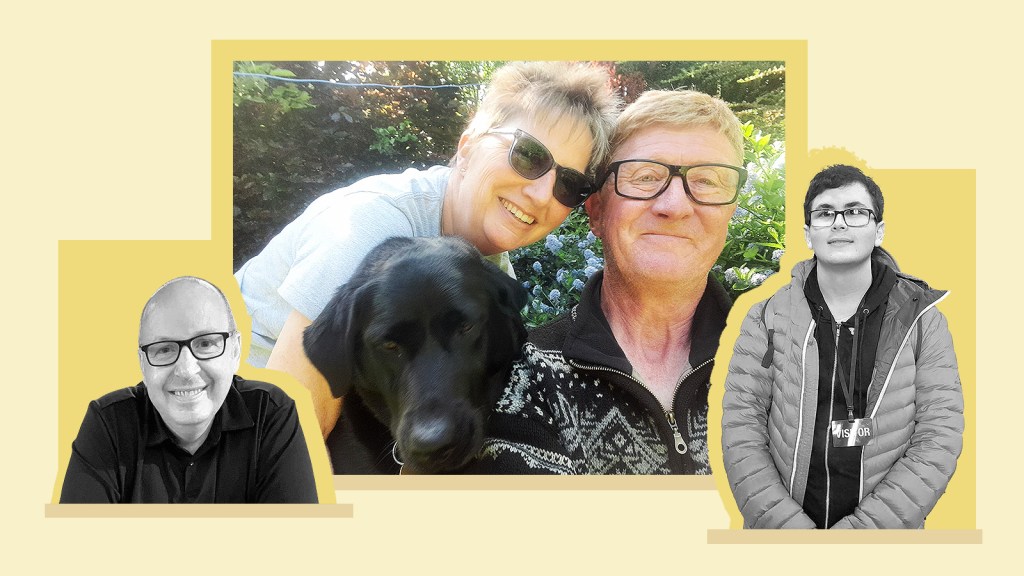

Josh Hall, a 19-year-old, is putting money aside for both a future home and a college degree, while John Collins, in his fifties, is mapping out an early retirement. Meanwhile, Brian and Catherine Stobbs have retired and established a financial cushion for unexpected expenses.

Despite their different life stages and circumstances, they share a common bond: a strong preference for cash Isas.

The cash Isa’s widespread appeal attracts both young and older savers who appreciate the stability offered by cash accounts compared to the erratic nature of the stock market. However, this affinity for cash Isas is increasingly at risk.

Each year, adults have a £20,000 allowance to allocate across different Isa types, including cash, stocks and shares, and lifetime Isas aimed at assisting first-time homebuyers and retirement savings. However, Chancellor Rachel Reeves is reportedly considering reforms to lower the maximum annual contribution to cash Isas, ostensibly to nudge savers toward investing.

Specifics regarding these changes remain unclear, but some influential figures in the finance sector have proposed a drastic reduction to as little as £4,000 per year.

In the last fiscal year, a remarkable £41.6 billion was deposited into cash Isas, in stark contrast to the £28 billion allocated to stocks and shares Isas, according to HM Revenue & Customs (HMRC).

Over time, it’s anticipated that investments may yield better returns than cash, a stance supported by the government and financial regulators who argue that an overly cautious approach by savers is detrimental to the UK economy.

The Financial Conduct Authority has cautioned that many high-income individuals are overly risk-averse, with research indicating that 61% of adults with over £10,000 in investable assets hold at least 75% of their funds in cash.

However, proponents of cash Isas argue that decreasing their annual contribution limit would likely not stimulate the investment behavior the Chancellor envisions.

Planning for Education and Homeownership

Josh Hall has accumulated approximately £10,000 in his cash Isa with Nottingham Building Society while balancing his job in finance and pursuing a part-time degree in forensic psychology at the Open University.

He is financing his education, which costs about £4,000 annually, without resorting to student loans.

“While I understand the rationale behind wanting to promote investment, I am not yet ready to face the risks associated with the stock market,” said Hall, a Derbyshire native. “My goal with this Isa is not retirement, but saving for immediate objectives like a house deposit. I find cash accounts more reliable compared to the unpredictable nature of stocks.”

His parents, who do not charge him rent while he continues to save, helped establish the account for him as a Junior Isa when he was 15, and he has added to it since he turned 18.

“Many people see the £20,000 allowance as a benefit mainly for the wealthy, but cutting it to £4,000 would be a significant setback. While I might not max out the £20,000, I could easily reach £4,000 quickly given my low expenses while living at home,” he explained.

Hall further stated, “If the limit were to be reduced, either I’d save for a deposit much more slowly or be liable for taxes on savings, which would diminish my interest earnings. That would be challenging.”

Financial advisors generally suggest that investments ideally span a minimum of five years to weather market fluctuations. Funds needed sooner are better kept in cash.

Robin Fieth, CEO of the Building Societies Association, commented, “Simply altering Isa limits won’t foster investment; instead, it will disadvantage individuals keen on saving for near-term goals, for whom investing may not be suitable.”

He added, “These accounts fulfill various practical needs, from saving for homes to managing finances during retirement. They are not dormant funds but serve essential purposes for savers and the financial institutions that utilize them for lending.”

Prioritizing Financial Security Over Risk

Conversely, Brian and Catherine Stobbs, both 61 and residing in Consett, Co Durham, feel uneasy about investing their accumulated cash Isa savings of £60,000 in equities. They recall when Isas were first introduced in 1999.

“When Isas came out, we jumped in, recognizing their potential as a safe haven with solid returns,” said Brian, who retired nine years ago following a lengthy career with a charity.

The Stobbs primarily invest their Isa funds in fixed accounts managed by Newcastle Building Society. Brian described their Isa savings as a safety net or funds for significant purchases, illustrating their prudent approach to finances.

Despite having some investments inherited from family, they remain uncomfortable with risking their hard-earned savings in stocks.

“Historically, our family has always been cautious with how we manage our money, and stock investments do not appeal to me. It seems like the government is grasping at solutions to foster growth,” Brian remarked.

Harry Donoghue, a financial advisor from The Private Office, noted, “Cash might get criticized for not yielding inflation-battling returns, but a lack of growth isn’t its primary purpose. It’s valued for its stability and ensuring access to funds as needed. Thus, cash Isas may be just as crucial for certain savers as stocks and shares Isas are for others.”

“A key risk we manage for our clients is sequencing risk. Even if stocks provide robust average returns, the timing of those returns can influence outcomes significantly. If an individual withdraws money during a downturn, it can convert temporary losses into lasting ones.”

Opting for Tax Over Investment Risks

A recent survey of 1,792 cash Isa savers conducted by investment platform AJ Bell found that 51% would simply shift their savings to a traditional account if the cash Isa allowance were to decrease. Conversely, only 20% indicated they would consider investing in the UK stock market, while 15% would look towards global stocks.

John Collins, 53, from Coventry, revealed that he plans to utilize a conventional savings account if the cash Isa threshold is lowered. He characterizes himself as “relatively risk-averse” and prioritizes secure access to his savings as he transitions into early retirement.

Collins, who works in customer service and lives with his partner Ruth, a family therapist, has saved around £16,000 in a Coventry Building Society cash Isa, intended to provide financial support during the gap before his state pension kicks in at 67. Although he contributes to a workplace pension, he primarily avoids investing.

“If I had additional funds, I might consider experimenting, but I wouldn’t want to jeopardize my future plans by possibly extending my working years due to poor investment performance,” Collins stated.

“Given the current savings rates, you don’t need much before you encounter taxation on your interest, making the cash Isa crucial. For people my age and older, protecting capital and its tax-free status is essential. Any reforms appear to pressure individuals into risks they’re not prepared to take.”

HMRC figures indicated that tax receipts from savings interest were projected to reach £10.4 billion in 2024-25, an increase from just £1.4 billion in 2021-22. Basic-rate taxpayers can earn up to £1,000 in interest tax-free, while higher-rate taxpayers have a £500 limit under the Personal Savings Allowance, which has not adjusted since 2016 despite rising interest rates.

Five years ago, a basic-rate taxpayer would need £70,922 to generate enough interest to incur tax under the PSA when the top easy-access account yielded 1.41% interest. Now, with the leading easy-access account offering rates of 4.77%, only £20,964 is needed for a basic-rate taxpayer to reach the same tax threshold.

Sarah Coles, a wealth manager at Hargreaves Lansdown, emphasized the importance of cash Isas in building tangible emergency funds without tax worry. “While maintaining some cash reserves is wise, balancing it correctly is challenging. Reducing tax incentives for cash Isas isn’t the solution and could expose responsible savers to taxation.”

Post Comment