spacequest-time.ru

Overview

Chase Bank Fee Waiver

Chase Total Checking · Our most popular checking account. It offers several ways to get the $12 Monthly Service Fee waived, including with a qualifying direct. The Chase Savings account has a monthly fee of $5 monthly fee which can be waived with a minimum balance at the beginning of each day of $ in the account, at. New and converted accounts will not be charged a Monthly Service Fee for at least the first two statement periods. After that the Monthly Service Fee will. Get all of the perks of Chase Premier Plus Checking℠ and we'll waive No Chase fee on the first four non-Chase ATM transactions each statement period. Some bank fees may be waived if you meet certain account requirements. In If you make a purchase with your debit card in another country, your bank may charge. ATM Fees —$0 Worldwide, No Chase fee · Non-Chase ATM transactions · Refund of ATM Surcharge Fees charged to you at non-Chase ATMs Footnote(Opens Overlay) · Foreign. You can also waive the Chase Business Complete Banking Monthly Service Fee when you make $2, in monthly purchases with your Chase Ink® Business Cards. Account Fees: Monthly Service Fee — $0 or $12, Overdraft Fees — $34, ATM Fees at Chase ATMs — $0, ATM Fees at Non-Chase ATMs — $3 to $5. Chase Platinum Business Checking℠ comes with a $95 Monthly Service Fee that can be waived by maintaining an average beginning day balance of $, ($50, Chase Total Checking · Our most popular checking account. It offers several ways to get the $12 Monthly Service Fee waived, including with a qualifying direct. The Chase Savings account has a monthly fee of $5 monthly fee which can be waived with a minimum balance at the beginning of each day of $ in the account, at. New and converted accounts will not be charged a Monthly Service Fee for at least the first two statement periods. After that the Monthly Service Fee will. Get all of the perks of Chase Premier Plus Checking℠ and we'll waive No Chase fee on the first four non-Chase ATM transactions each statement period. Some bank fees may be waived if you meet certain account requirements. In If you make a purchase with your debit card in another country, your bank may charge. ATM Fees —$0 Worldwide, No Chase fee · Non-Chase ATM transactions · Refund of ATM Surcharge Fees charged to you at non-Chase ATMs Footnote(Opens Overlay) · Foreign. You can also waive the Chase Business Complete Banking Monthly Service Fee when you make $2, in monthly purchases with your Chase Ink® Business Cards. Account Fees: Monthly Service Fee — $0 or $12, Overdraft Fees — $34, ATM Fees at Chase ATMs — $0, ATM Fees at Non-Chase ATMs — $3 to $5. Chase Platinum Business Checking℠ comes with a $95 Monthly Service Fee that can be waived by maintaining an average beginning day balance of $, ($50,

JPMorgan Chase Bank, N.A. Member FDIC. © JPMorgan $0 Monthly Service Fee – Chase Military Banking offers all the benefits of Chase Premier Plus. PLUS these convenient account features: No Monthly Service Fee on these accounts when linked: Other miscellaneous fees apply. See Additional Banking. No monthly fees, no minimums and no overdraft fees. Access your money & bank almost anywhere with our top-rated mobile app. so your money stays where it. Fees may vary based on the type of account you have because some accounts offer fee waivers for some services. For a complete list of services, fees, and fee. You can avoid the monthly fee on Chase Total Checking by maintaining a minimum daily opening balance of $1, See spacequest-time.ru With TD Overdraft Relief1, we offer you even more flexibility—including no fee if you overdraw your checking account balance by $50 or less. This account charges a monthly service fee of up to $12, but the fee may be waived if you keep a minimum balance of $5, No minimum initial deposit. There. *For new Rewards Savings accounts Bank of America will waive the monthly fee for the first 6 months from the account's opening. Required Opening Deposit of $ No fees on everyday banking Rate Adjustment Fee. No Chase Fee for incoming and outgoing wire transfers. No fees on rushed debit card replacement (upon. There is a $12 monthly account fee associated with the Total Checking from Chase The bank also waives ATM withdrawal fees nationwide (up to $25 per month). Fees. The Chase Total Checking® account has a monthly service fee of $12, but you may qualify for a fee waiver. Aside from child and student accounts, Chase. Chase Business Complete Banking · Waive the Monthly Service Fee if you achieve $2, of minimum daily balance, deposits from Chase QuickAccept®, or Chase Ink. Important Information about Chase Business Complete Banking There is a $15 Monthly Service Fee (MSF) that we'll waive if you meet any of the below qualifying. The $6 monthly maintenance fee can be waived if you're a college student 17 to 24 at account opening. You just need to show proof of enrollment, which can be a. If you use a non-Chase ATM, you will pay $3 to $5 for any transactions. That's above any fees charged by the ATM owner. Chase Secure Banking℠. Chase SapphireSM Checking has a monthly service fee of $25, which can be waived if you have a combined daily minimum balance of $75, across linked Chase. The Chase bank customer service phone number is +1 () Nervous about asking Chasing for an overdraft fee waiver? Here are some tips about how to. No fee for Chase design checks when ordered through spacequest-time.ru fee for counter checks, money orders and cashier's spacequest-time.ru Chase fee on 4 non-Chase ATM. The monthly fee is also waived for military members. For Chase Sapphire Checking, the monthly fee can be avoided by maintaining an average beginning day balance. PLUS these convenient account features: No Monthly Service Fee on these accounts when linked: Other miscellaneous fees apply. See Additional Banking.

How Do I Find Out Where My 401k Is

A (k) plan is a workplace retirement plan that allows you to make annual contributions up to a specific limit and invest that money for your later years. 1. Leave your balance with the old plan. This is certainly the easiest option; you don't have to do anything and your money stays in the old (k). How To Find My (k)? · 1. Contact Your Former Employer · 2. Locate An Old (k) Statement · 3. Search Unclaimed Assets Databases · 4. Find (k)s with your. Your k is not growing, which can be related to your investments and other internal and external factors. See the (k) Resource Guide for details on (k) topics for plan participants and plan sponsors. 1. Leave your balance with the old plan. This is certainly the easiest option; you don't have to do anything and your money stays in the old (k). Check with the Internal Revenue Service (IRS): If you have a traditional (k) plan, the IRS may have information on your plan if it was. In order to evaluate different funds in your (k)—or to understand what your financial professional is saying—you need a basic knowledge of investing. It also. A Rollover IRA is a retirement account that allows you to roll money from your former employer-sponsored retirement plan into an IRA. A (k) plan is a workplace retirement plan that allows you to make annual contributions up to a specific limit and invest that money for your later years. 1. Leave your balance with the old plan. This is certainly the easiest option; you don't have to do anything and your money stays in the old (k). How To Find My (k)? · 1. Contact Your Former Employer · 2. Locate An Old (k) Statement · 3. Search Unclaimed Assets Databases · 4. Find (k)s with your. Your k is not growing, which can be related to your investments and other internal and external factors. See the (k) Resource Guide for details on (k) topics for plan participants and plan sponsors. 1. Leave your balance with the old plan. This is certainly the easiest option; you don't have to do anything and your money stays in the old (k). Check with the Internal Revenue Service (IRS): If you have a traditional (k) plan, the IRS may have information on your plan if it was. In order to evaluate different funds in your (k)—or to understand what your financial professional is saying—you need a basic knowledge of investing. It also. A Rollover IRA is a retirement account that allows you to roll money from your former employer-sponsored retirement plan into an IRA.

Costs directly related to the purchase of your primary home (excluding mortgage payments), stop eviction from your primary home or to stop foreclosure on your. To find your (k), contact your former employer or search through unclaimed property databases. Once you've secured your old funds, keep tabs on its location. The (k) Calculator can estimate a (k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary. Generally, if you withdraw money from your (k) account before age 59 1/2, must pay a 10% early withdrawal penalty, in addition to income tax, on the. Participate in a (k) plan · Contribution limits · General guidance on participating in your employer's plan. You can find your (k) by either using Capitalize's (k) Finder tool or using the Department of Labor's Abandoned Plan site. Contributing the proper amount to a (k) plan is an important part of successful retirement saving. Learn how much to save in your (k) and more. If you are trying to find the money left in your former employer's (k), here are possible places to find them: Old (k) under your employer's management. ADP k Retirement Plan Login. Help Before you begin, make sure you have received the registration code from your company administrator or ADP. The best way to do that is by looking at the fund return performance in the investment pamphlet that you're given with your (k). The key here is not to look. Reach out to your HR department to see if they have an exit packet with these details. Make note of the vested amount in your retirement accounts too—it will. You can check the balance of your k by contacting the plan administrator or trustee. They should be able to provide you with a statement of. A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. The first and best method of locating a k is to contact your old employers. Ask them to check their plan records to see if you ever participated in their. There are several options available: staying in your former employer's plan, rolling over to an IRA and others. What you choose to do will depend on your. How can I find my old k account? The good news is that it's relatively painless to locate lost funds in unclaimed k accounts. Online resources such as. Like with consolidating your accounts in your new employer plan, moving your funds to an IRA allows you to remain invested and allow your money to grow tax. When you left your last job, you may have forgotten something: your money. No, not the coins in your desk drawer. The retirement plan money in your (k). What. We can help you find a plan that allows your employees to achieve their retirement goals while putting tax savings in your pocket. Cashing Out Your k while Still Employed. Typically, you can't close an employer-sponsored k while you're still working there. You could elect to suspend.

Calculation Of Installment

Excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will. Repayment terms vary, according to lender terms and how much money is borrowed, but monthly payments always contain interest obligations. Each installment also. Equated Monthly Installment (EMI) Formula. The EMI flat-rate formula is calculated by adding together the principal loan amount and the interest on the. Loan Calculator. Calculate Your Monthly Payment. Your monthly payment for a loan will depend on the amount, term, and interest rate of the loan. Use the. Interest Rate (%). Calculate. You could borrow up to Rs. 0. Your monthly repayment Rs. 0. Apply for loan. Apply For Fixed Deposit. Apply For Loan. Apply For. the formula for calculation: a = p(1 + (r*t)); personal loan calculator: personal loan calculator allows you to calculate your EMI using variables like the. The formula for calculating EMI is EMI = P x r x (1+r)^n/[(1+r)^n-1], where P is the principal, r is the interest rate, and n is the number of installments. To. Enter your loan amount, interest rate, and loan term into the calculator fields. · We calculate the monthly payment based on the values you've provided. · We. An equated monthly installment is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. Excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will. Repayment terms vary, according to lender terms and how much money is borrowed, but monthly payments always contain interest obligations. Each installment also. Equated Monthly Installment (EMI) Formula. The EMI flat-rate formula is calculated by adding together the principal loan amount and the interest on the. Loan Calculator. Calculate Your Monthly Payment. Your monthly payment for a loan will depend on the amount, term, and interest rate of the loan. Use the. Interest Rate (%). Calculate. You could borrow up to Rs. 0. Your monthly repayment Rs. 0. Apply for loan. Apply For Fixed Deposit. Apply For Loan. Apply For. the formula for calculation: a = p(1 + (r*t)); personal loan calculator: personal loan calculator allows you to calculate your EMI using variables like the. The formula for calculating EMI is EMI = P x r x (1+r)^n/[(1+r)^n-1], where P is the principal, r is the interest rate, and n is the number of installments. To. Enter your loan amount, interest rate, and loan term into the calculator fields. · We calculate the monthly payment based on the values you've provided. · We. An equated monthly installment is a fixed payment amount made by a borrower to a lender at a specified date each calendar month.

Easy steps to calculate monthly payment. Loan Calculator. Loan Amount?: Number of Months? (#): Annual Interest Rate?: Payment Method?. An equated monthly installment (EMI) is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. To calculate the total amount paid on a loan, multiply the monthly payment by the number of months in the period. What is the monthly payment formula for fixed. The formula to calculate EMI is EMI = [P x R x (1+R)^N] / [(1+R)^N - 1], where P is the principal amount, R is the monthly interest rate, and N is the number of. The calculation of EMI requires three inputs: the total principal amount, interest rate, and term of the loan. There are two methods to calculate EMI: the flat-. calculation – a monthly payment at a 5-year fixed interest rate of % amortized over 25 years. Don't worry, you can edit these later. Calculate. Mortgage. The equated quarterly instalment for the given figures will be =PMT(10%/4, 20*4, 10,00,). USING MATHEMATICAL FORMULA Unfortunately, you cannot access the. There are two possible configurations for collecting installment payments with compound interest: Collection at the **beginning of the period**;. To calculate the EMI, you need to know the principal amount, interest rate, and loan tenure. Here's a step-by-step guide to calculating the EMI. To calculate the EMI, you need to know the principal amount, interest rate, and loan tenure. Here's a step-by-step guide to calculating the EMI. Schedule Preview for Declining Balance (Equal Instalments) Interest Calculation Method. Non-equal installments due to rounding and first repayment date. In. The BankBazaar Equated Monthly Instalment Calculator is very easy to use. It uses some basic details of the loan that you are willing to avail. The rate of interest is a vital factor that will help to assess the installment amount owed. You can compare the product and opt for one which has a lower rate. Quickly calculate a loan payment and see a payoff schedule. Loan details. Loan amount. Interest rate. You can then use a mortgage calculator or a formula to determine the monthly payment. The formula is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where M is the. What is Home Loan EMI Calculator? Home Loan EMI Calculator assists in calculation of the loan installment i.e. EMI towards your home loan. It an easy to use. EMI Calculator - Calculate Equated Monthly Installment (EMI) for Home Loan / Housing Loan, Car Loan & Personal Loan in India (with interactive charts). the formula for calculation: a = p(1 + (r*t)); personal loan calculator: personal loan calculator allows you to calculate your EMI using variables like the. How to calculate your loan cost · Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment.

Does It Matter Where You Open A Roth Ira

Keep in mind, you can only contribute as much as you earn. If your income is less than the contribution limit, then you can only contribute the amount you have. How does a Roth IRA work? · You choose to put some of your income into these plans now to save for retirement later. · The money is a voluntary amount you can. A Roth IRA offers many benefits to retirement savers, and one of the best places to get this tax-advantaged account is at an online brokerage or robo-advisor. Open a Roth or Traditional IRA today. To discuss your investment Should You Convert to a Roth IRA? A Roth IRA conversion occurs when you take. While the ultimate goal of a Roth IRA is accumulating money for retirement, it's an incredibly flexible account that lets you withdraw contributions at any time. How we scored Roth IRAs ; Minimum opening deposit requirement (10%), While the IRS does not require a minimum deposit for Roth IRAs, many financial institutions. Opening a Roth IRA is easy as long as you have all the required information and documentation. · Roth IRAs provide no upfront tax benefit but do provide tax-free. There are no mandatory withdrawals, and you can continue to invest in a Roth IRA no matter your age as long as you have earned income and meet the income limits. As long as you don't exceed the IRS's income limits, you can still contribute the maximum annual amount to a Roth IRA. For the tax year that's $7,, or. Keep in mind, you can only contribute as much as you earn. If your income is less than the contribution limit, then you can only contribute the amount you have. How does a Roth IRA work? · You choose to put some of your income into these plans now to save for retirement later. · The money is a voluntary amount you can. A Roth IRA offers many benefits to retirement savers, and one of the best places to get this tax-advantaged account is at an online brokerage or robo-advisor. Open a Roth or Traditional IRA today. To discuss your investment Should You Convert to a Roth IRA? A Roth IRA conversion occurs when you take. While the ultimate goal of a Roth IRA is accumulating money for retirement, it's an incredibly flexible account that lets you withdraw contributions at any time. How we scored Roth IRAs ; Minimum opening deposit requirement (10%), While the IRS does not require a minimum deposit for Roth IRAs, many financial institutions. Opening a Roth IRA is easy as long as you have all the required information and documentation. · Roth IRAs provide no upfront tax benefit but do provide tax-free. There are no mandatory withdrawals, and you can continue to invest in a Roth IRA no matter your age as long as you have earned income and meet the income limits. As long as you don't exceed the IRS's income limits, you can still contribute the maximum annual amount to a Roth IRA. For the tax year that's $7,, or.

Does it matter how old I am or whether I participate in a retirement plan at work? No. You can contribute to a Roth IRA at any age if you have earned income . How we scored Roth IRAs ; Minimum opening deposit requirement (10%), While the IRS does not require a minimum deposit for Roth IRAs, many financial institutions. And unlike a traditional IRA, you're never required to take minimum distributions from your Roth IRA if you originally opened the account. Quick Comparison. The money contributed to them can grow tax deferred. This can be a powerful advantage to you. Because if you don't pay taxes on this growth while it's in the. However, there are income limitations to opening a Roth IRA, so not everyone will be eligible for this type of retirement account. Learn more about Roth vs. As long as you have earned compensation, whether it is a regular paycheck or income for contract work, you can contribute to a Roth IRA—no matter how old. If, over time, you open multiple Roth IRAs in addition to your original account, the 5-year period start date for all of them would revert back to that of your. There are no income limits to open and fund traditional IRAs. You can't use a Roth IRA unless your income falls below a certain dollar amount. (See eligibility. You can also open a new Roth IRA at a different financial institution, and then have the funds in your traditional IRA transferred directly to your new Roth IRA. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. You can do this in various ways, including through a credit union or bank or an investment firm, many of which offer Roth IRAs, among other types of retirement. To be clear, this oversimplifies things quite a bit—these accounts come with various eligibility rules and contribution limits that could affect your choice—but. Pay taxes on contributions up front, and make tax-free withdrawals later. A Roth IRA may work best if you anticipate being in a higher tax bracket at retirement. At MissionSquare, you can open a Roth, a traditional IRA, or both. IRA Brokerage Account What's the Difference? Excess IRA Contributions · Financial. With a Roth IRA, you pay income taxes on money you deposit into your account. But when you withdraw money during retirement, you don't owe taxes on it. As the. There are no mandatory withdrawals, and you can continue to invest in a Roth IRA no matter your age as long as you have earned income and meet the income limits. With a Roth IRA, you pay income taxes on money you deposit into your account. But when you withdraw money during retirement, you don't owe taxes on it. As the. Traditional & Roth IRAs: Yes. How much can I contribute? Contribution limits may change from year to year and may depend on your household income. Consult the. If you think your tax bracket will be higher when you withdraw than it is when you contribute—say, you're just starting out in your career or simply want to.

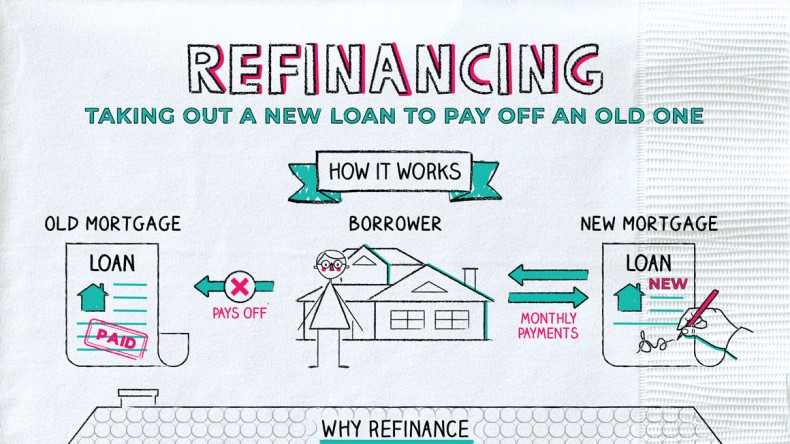

Do You Get Money For Refinancing Your House

Getting money out of refinance is not income. It is a shift of assets - lowering the equity in the house by increasing the loan size and moving. Refinancing is a great option for converting equity into much-needed funds. It is a secure loan with a lower interest rate compared to other personal loans. However, many lenders say 1% savings is enough of an incentive to refinance. Using a mortgage calculator can help you see how much you might save. A lower. If you refinance, you get the opportunity to lower your interest rate and save thousands of dollars off your total loan payment. You can cash out your equity . However, if you only recently started paying your mortgage, it may be beneficial to refinance in order to secure a better interest rate or other favorable loan. With a cash-out refinance, you're refinancing your mortgage for more than you currently owe. In return, you're getting a portion of your equity back in cash. Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%. How do I qualify for a cash-out refinance loan? To qualify for a cash-out refinance loan you will need to get your home appraised. The appraisal value will. You replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, pretend you have a $, Getting money out of refinance is not income. It is a shift of assets - lowering the equity in the house by increasing the loan size and moving. Refinancing is a great option for converting equity into much-needed funds. It is a secure loan with a lower interest rate compared to other personal loans. However, many lenders say 1% savings is enough of an incentive to refinance. Using a mortgage calculator can help you see how much you might save. A lower. If you refinance, you get the opportunity to lower your interest rate and save thousands of dollars off your total loan payment. You can cash out your equity . However, if you only recently started paying your mortgage, it may be beneficial to refinance in order to secure a better interest rate or other favorable loan. With a cash-out refinance, you're refinancing your mortgage for more than you currently owe. In return, you're getting a portion of your equity back in cash. Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%. How do I qualify for a cash-out refinance loan? To qualify for a cash-out refinance loan you will need to get your home appraised. The appraisal value will. You replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. For example, pretend you have a $,

These loans can be used as strictly cash at closing, to payoff debt, make home improvements, and pay off liens. The Cash-Out Refinance Loan can also be used to. Determine your primary goal: Are you looking to lower your monthly mortgage payment by securing a more favorable interest rate or get cash to finance a new. If interest rates drop significantly, refinancing could lower your payments or help you pay down your mortgage faster. Use home equity. If you've paid down part. So, how does a cash-out refinance work? When you use a cash-out refi, you're essentially trading in your old mortgage for a new home loan that happens to have a. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. The equity in your home: For cash-out refinancing, most lenders will usually allow you to borrow up to 80% of the value of your home. As such, the cash amount. It's not a given that refinancing is your best option. Whether you wait until your renewal period, or need to refinance or change lenders in the middle of your. Some mortgages allow a “cash-out” refinance, so you can turn some of your home equity into cash or use it to pay off high-cost debt. The money you take out will. If done right, mortgage refinancing can save you a lot of money by lowering interest rates. It can also give you access to the equity you already have in your. You pay back the new loan over time, usually between 15 and 30 years. Your home acts as collateral on the loan, just like with a regular mortgage. How does a. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. No, the cash you receive from a cash out refinance isn't taxed. That's because the IRS considers the money a loan you must pay back rather than income. Essentially, cash-out refinancing allows you to access the money you have already put into your home without actually selling your home. How Does It Work? Say. In a cash-out refi, you borrow more than you owe on your current mortgage, pay off that loan, get a new mortgage, and receive a cash disbursement of the extra. Lower monthly payments can come with lower interest rates, but you can also lower your payments and have extra cash each month for other expenses by lengthening. Banks will typically tack fees onto the refinancing process, assuming you're refinancing to save money, these fees will offset that savings. Refinancing your mortgage means using the net value of your home to borrow more money. Your mortgage amount generally increases when you refinance. Refinancing your mortgage can be a great way to access the equity in your home for the things that matter to you. Learn more and talk to an expert today. A cash-out refinance loan — also known as a cash-out refi — is when you refinance your existing mortgage for more than you owe and take the difference in cash. Borrowers with a conventional mortgage and 20% equity are not required to have PMI. When should I refinance my FHA mortgage? After waiting the required period.

Online Banks That Accept Cash Deposits

However, it also offers excellent deposit account options, including rewards checking and high-yield savings. The Cash Rewards checking account from Laurel Road. GET GOING WITH GOBANK · Download the award-winning app · ASAP Direct Deposit™ · Free ATM network · Deposit Cash · Mobile check deposit · Pay Bills · Monthly Fee Waiver. banking needs allow you to track Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. ATM Cash & Check Deposit Instructions. ATM Check Deposit Step 1. Step 1 Your online banking experience just got better. The Private Bank Hub, while. All banks have guidelines on how deposits get processed. If you deposit cash, that money goes directly to your account and will be ready for you to use. Academy Bank has 9 month CD accounts at % APY*. Locations in Kansas, Missouri, Colorado & Arizona. Plus online banking anywhere! Everyday banking at your fingertips, thanks to touch screens · $ quick cash withdrawal from your chequing account right from the main menu · Envelope-free. Allpoint gives you freedom to get your cash how you want, without ATM surcharge fees, at over 55, conveniently-located ATMs. And now, Allpoint+ deposit-. take 3 to 5 business days to process. How to cancel a bill payment. If you paid a bill through BMO Online Banking, Mobile Banking, Telephone Banking or at a. However, it also offers excellent deposit account options, including rewards checking and high-yield savings. The Cash Rewards checking account from Laurel Road. GET GOING WITH GOBANK · Download the award-winning app · ASAP Direct Deposit™ · Free ATM network · Deposit Cash · Mobile check deposit · Pay Bills · Monthly Fee Waiver. banking needs allow you to track Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. ATM Cash & Check Deposit Instructions. ATM Check Deposit Step 1. Step 1 Your online banking experience just got better. The Private Bank Hub, while. All banks have guidelines on how deposits get processed. If you deposit cash, that money goes directly to your account and will be ready for you to use. Academy Bank has 9 month CD accounts at % APY*. Locations in Kansas, Missouri, Colorado & Arizona. Plus online banking anywhere! Everyday banking at your fingertips, thanks to touch screens · $ quick cash withdrawal from your chequing account right from the main menu · Envelope-free. Allpoint gives you freedom to get your cash how you want, without ATM surcharge fees, at over 55, conveniently-located ATMs. And now, Allpoint+ deposit-. take 3 to 5 business days to process. How to cancel a bill payment. If you paid a bill through BMO Online Banking, Mobile Banking, Telephone Banking or at a.

ATM Cash & Check Deposit Instructions. ATM Check Deposit Step 1. Step 1 Your online banking experience just got better. The Private Bank Hub, while. Online Banking. Personal Online Banking · Business Online Banking · Security · FAQ Safer than cash and more convenient than checks. Stop into any of our. take no more than two minutes. You'll also want nearby ATMs that can accept cash deposits. Higher interest rates on checking and savings. In general, online. Learn about the convenience and ease of depositing paper checks into your account using the Mobile Banking app with Mobile Check Deposit from Bank of. Online Banking Benefits · Compare Fee-Free Overdraft Options Access Capital One's Location Finder to find an ATM that accepts cash deposits near you. To deposit cash into your Checking account, you can always hit up a Capital One ATM. Select Allpoint® partner ATMs accept cash deposits, too. Click here to. Online Banking Icon. Online Banking. Secure, hour access to your banking Self-Service and Cash Deposits. Insert Credit Card. BECU ATMs. Make deposits. Yes, ATMs in Canada can accept cash deposits, but not all of them do. ATMs owned by big banks are the most likely to allow a cash deposit. We recommend three different ways to deposit cash into your online bank account: Make a deposit at a cash-accepting ATM. There are thousands of cash. Allpoint gives you freedom to get your cash how you want, without ATM surcharge fees, at over 55, conveniently-located ATMs. And now, Allpoint+ deposit-. Register for CIBC Mobile and Online Banking. Register once and A chequing account allows you to deposit money including cash, cheques or direct deposit. All banks have guidelines on how deposits get processed. If you deposit cash, that money goes directly to your account and will be ready for you to use. Open a Wells Fargo checking account online in minutes. Get Mobile Banking, Bill Pay, and access to ATMs. Mobile Check Deposit · Deposit checks⁶ using the camera on your smart phone or tablet · Save a trip to the bank · Deposit up to $20, for personal accounts and. Enjoy banking made easy with Ally Bank's Spending Account - online Can I deposit cash? No, we don't accept cash. But you can make a deposit. GET GOING WITH GOBANK · Download the award-winning app · ASAP Direct Deposit™ · Free ATM network · Deposit Cash · Mobile check deposit · Pay Bills · Monthly Fee Waiver. Make deposits when you want, any time of day · No envelopes or deposit slips needed · Get fast credit for cash deposits · Less waiting – deposits made before 8. You can make check and cash deposits at virtually any Chase ATM 24 hours a Chase online lets you manage your Chase accounts, view statements. You can make check and cash deposits at virtually any Chase ATM 24 hours a Chase online lets you manage your Chase accounts, view statements. Summit Community Bank ; Get it free in the app or online banking. Track your credit goals and so much more ; Interactive Teller Machine. Enjoy Extended Banking.

Home Warranty For Mobile Homes

Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. A home warranty is a renewable service contract that protects homeowners against the cost of unexpected repair or replacement of covered home systems and. Your new home is covered by a 7-Year Extended Warranty. During the course of construction, the design and the quality of workmanship of your home will have been. All homes constructed and registered by our Builder Members come with a comprehensive warranty, which includes desposit protection. Builders may choose from our. Mobile home and recreational vehicle warranties. The warranty requirements of each manufacturer, dealer, installer, and supplier of mobile homes or. The HBW is an insurance-backed structural warranty. It provides 10 years of coverage against qualifying structural defects. The defects must be load-. A mobile home warranty can help cover the replacement and repair costs of those appliances and systems, ensuring that you don't get stuck with an overwhelming. When you purchase a brand new manufactured home, the factory itself issues a one year service warranty for specific areas of maintenance on the home. Our programs protect the structure of your mobile home; original systems (such as plumbing, electrical system, water heater, and central heat and air. Fidelity National Home Warranty - Order a home protection plan from Fidelity National Home Warranty and enjoy peace of mind in your home. A home warranty is a renewable service contract that protects homeowners against the cost of unexpected repair or replacement of covered home systems and. Your new home is covered by a 7-Year Extended Warranty. During the course of construction, the design and the quality of workmanship of your home will have been. All homes constructed and registered by our Builder Members come with a comprehensive warranty, which includes desposit protection. Builders may choose from our. Mobile home and recreational vehicle warranties. The warranty requirements of each manufacturer, dealer, installer, and supplier of mobile homes or. The HBW is an insurance-backed structural warranty. It provides 10 years of coverage against qualifying structural defects. The defects must be load-. A mobile home warranty can help cover the replacement and repair costs of those appliances and systems, ensuring that you don't get stuck with an overwhelming. When you purchase a brand new manufactured home, the factory itself issues a one year service warranty for specific areas of maintenance on the home. Our programs protect the structure of your mobile home; original systems (such as plumbing, electrical system, water heater, and central heat and air.

A home warranty is a yearly service contract which covers the repair and replacement of important household appliances and home system components that. The answer is that most of them are. Warranties on manufactured homes vary between manufacturers. Some warranties may include appliances in the manufactured. Yes, Clayton's new homes have a standard one-year limited warranty that covers defects that could occur in your home. Many appliance manufacturers also have. A home warranty plan protects the appliances and systems in your home: major home appliances, electrical, plumbing, and HVAC systems. Unlike your homeowners. Mobile homes located on a permanent foundation are eligible for enrollment in the HBW Structural Warranty program for Manufactured/Modular homes. A home warranty helps cover repair or replacement costs on your home's systems and appliances when they break down due to normal wear and tear. A home warranty. Limited Warranty provides a one-year limited warranty for every home we build. Click on the MHE logo below to view our warranty. For even more peace of mind we. The HBW is an insurance-backed structural warranty. It provides 10 years of coverage against qualifying structural defects. The defects must be load-. Alamo Homes offers a free Lifetime Home Warranty on all new single and double wide mobile homes we sell in Texas. Click to see more details. As previously mentioned, most home manufacturers include one-year warranties on new homes that they sell. These warranties cover any potential defects in the. We offer home warranty coverage for the following property types: Single-family homes; Duplexes, triplexes, and quadplexes; Townhomes and condos; Mobile homes. Alamo Homes offers a free Lifetime Home Warranty on all new single and double wide mobile homes we sell in Texas. Click to see more details. A home warranty is a renewable service contract that protects homeowners against the cost of unexpected repair or replacement of covered home systems and. New manufactured homes are sold with express warranties, just like new motor vehicles, and they must conform to those warranties. In addition, they must. As previously mentioned, most home manufacturers include one-year warranties on new homes that they sell. These warranties cover any potential defects in the. With 50+ years of experience, American Home Shield® offers reliable home warranty coverage and exceptional service for homeowners across America. Warranty · Factory PRO Exclusive 10 Year Warranty. The Moduline FactoryPro Warranty is designed to specifically protect new manufactured home buyers. · Peace of. New home warranty is insurance coverage that comes with most newly built homes. It protects the homeowner against construction defects for a specified amount. Whether you live in a single-family home, condo, mobile home, or townhome, there's a First American home warranty for you. Mobile Homes. Manufactured homes. We know that our homes are some of the best built homes in the nation, and that's why we provide you with a 7-Year Extended Warranty.

Chase Reserve Vs Capital One Venture

application fee credit. Global Entry or TSA PreCheck® or NEXUS Fee Credit. Receive one statement credit of up to $ every four years as reimbursement for. The Venture X has a $ annual fee, while the Sapphire Reserve has a $ annual fee. Additionally, the Venture X doesn't charge for adding authorized users. Compare Chase Sapphire Reserve vs Capital One Venture and see which is better. View side-by-side comparison of rewards, rates, fees, and benefits at. credit limit. Chase Sapphire Reserve. Chase Sapphire Reserve Vs Capital One Venture X Reddit One Venture Card has a healthy welcome bonus: New. (Priority. Venture X is better in terms of AF and it provides equally good lounge benefits, but I've heard that Chase points are more valuable. The 2 miles per dollar you get for “other purchases” with Capital One beats Chase's 1 point per dollar rate, but that only helps you come out ahead if you aren'. The Chase Sapphire Reserve offers higher reward value, especially for those who maximize the Ultimate Rewards portal and travel frequently. Capital One Venture. Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Credit Card. Chase Sapphire Reserve® vs. Capital One Venture X Rewards Credit. Compare Chase Sapphire Reserve vs Capital One Venture and see which is better. View side-by-side comparison of rewards, rates, fees, and benefits at. application fee credit. Global Entry or TSA PreCheck® or NEXUS Fee Credit. Receive one statement credit of up to $ every four years as reimbursement for. The Venture X has a $ annual fee, while the Sapphire Reserve has a $ annual fee. Additionally, the Venture X doesn't charge for adding authorized users. Compare Chase Sapphire Reserve vs Capital One Venture and see which is better. View side-by-side comparison of rewards, rates, fees, and benefits at. credit limit. Chase Sapphire Reserve. Chase Sapphire Reserve Vs Capital One Venture X Reddit One Venture Card has a healthy welcome bonus: New. (Priority. Venture X is better in terms of AF and it provides equally good lounge benefits, but I've heard that Chase points are more valuable. The 2 miles per dollar you get for “other purchases” with Capital One beats Chase's 1 point per dollar rate, but that only helps you come out ahead if you aren'. The Chase Sapphire Reserve offers higher reward value, especially for those who maximize the Ultimate Rewards portal and travel frequently. Capital One Venture. Capital One Venture Rewards Credit Card and Capital One Venture X Rewards Credit Card. Chase Sapphire Reserve® vs. Capital One Venture X Rewards Credit. Compare Chase Sapphire Reserve vs Capital One Venture and see which is better. View side-by-side comparison of rewards, rates, fees, and benefits at.

With Capital One Venture cards or the Venture X Business card, you can earn unlimited miles that never expire and travel anywhere, anytime, with no blackout. If you have both, which one is more beneficial? Some say that Chase points can be transferred to Hyatt and is better. But is it worth $ annual fee while. Capital One Venture X Rewards Credit Card has a significantly lower annual fee than the Chase Sapphire Reserve® card. Cardholders pay an annual fee of just $ Bottom Line: While both cards come with several travel benefits and protections, the Chase Sapphire Reserve card is by far the winner for the frequent traveler. Right off the numbers, Venture wins, but that's mainly because Venture's an "overall expenses" credit card, whereas Sapphire Reserve is a "sctrictly travel". Compare Chase Sapphire Reserve vs Capital One Venture and see which is better. View side-by-side comparison of rewards, rates, fees, and benefits at. The Capital One Venture X is a premium travel rewards card with a reasonable annual fee. For $ a year, it's a bit cheaper to carry than the Reserve, and it's. while the Chase Sapphire Reserve gives you a priority pass. select membership to plus VIP airport lounges worldwide. now the one I'm personally considering. Earn miles on every purchase and enjoy unlimited mile rewards with a Capital One Venture travel card. Earn up to $50 in statement credits each year for hotel stays booked through the Chase Ultimate Rewards Travel Portal. Complimentary access to the Capital One. Right off the numbers, Venture wins, but that's mainly because Venture's an "overall expenses" credit card, whereas Sapphire Reserve is a "sctrictly travel". 1. Annual fees. The Capital One Venture has a $95 annual fee, whereas the Chase Sapphire Reserve has a $ annual fee. If you want a similar Chase credit card. Comparable Cards · The Platinum Card® from American Express · Capital One Venture X Business · Capital One Venture X Rewards Credit Card. Capital One Venture X vs. Chase Sapphire Reserve: Which premium card comes out on top? spacequest-time.ru Capital One Venture X vs Chase Sapphire Reserve However there are some notable differences. For one, the annual fee is significantly less, clocking in at $ If you have both, which one is more beneficial? Some say that Chase points can be transferred to Hyatt and is better. But is it worth $ annual fee while. When looking for a premium credit card, you cannot go wrong with choosing between the Capital One Venture X vs Chase Sapphire Reserve. Earn unlimited miles with the Capital One Venture Rewards travel credit card. Redeem anytime with no seat restrictions or blackout dates. The Capital One Venture Rewards card has a simpler rewards program, but the Chase Sapphire Preferred card's points could be worth more. The Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred Card share a lot of similarities. For example, the Venture has an annual fee of $

Best 0 Interest Rate Balance Transfer Credit Cards

Best for no fees: Citi Simplicity® Card. With no annual fee, late fees, or penalty APR, the Citi Simplicity® Card stands out as a consumer-friendly option. If you transfer a balance from a high-interest credit card to a Discover Card with an introductory 0% APR balance transfer offer, you can use the money you save. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Citi Simplicity® Card: Best feature: 0% introductory APR promotion. However, we suggest you beware, because a 0% balance transfer card might not actually be as good as it might seem. Yes, a 0% interest balance card may benefit. “The Citi Double Cash allows new cardholders to enjoy 0% APR for 18 months on balance transfers. The best part of the Citi Double Cash is that it comes with no. Citi Double Cash® Card: 0% intro period for the first 18 months on balance transfers (after, % - % variable APR; see rates and fees). Balance. Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months ; Citi Rewards+® Card · reviews · Intro balance transfer APR. 0% for 15 Months. Balance Transfer Credit Cards · Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card. Bank of America® Unlimited Cash Rewards credit card. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within. Best for no fees: Citi Simplicity® Card. With no annual fee, late fees, or penalty APR, the Citi Simplicity® Card stands out as a consumer-friendly option. If you transfer a balance from a high-interest credit card to a Discover Card with an introductory 0% APR balance transfer offer, you can use the money you save. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Citi Simplicity® Card: Best feature: 0% introductory APR promotion. However, we suggest you beware, because a 0% balance transfer card might not actually be as good as it might seem. Yes, a 0% interest balance card may benefit. “The Citi Double Cash allows new cardholders to enjoy 0% APR for 18 months on balance transfers. The best part of the Citi Double Cash is that it comes with no. Citi Double Cash® Card: 0% intro period for the first 18 months on balance transfers (after, % - % variable APR; see rates and fees). Balance. Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months ; Citi Rewards+® Card · reviews · Intro balance transfer APR. 0% for 15 Months. Balance Transfer Credit Cards · Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card. Bank of America® Unlimited Cash Rewards credit card. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within.

The idea is that the lower rate will save you money on interest. The best balance transfer credit cards usually come with no annual fee and a 0% intro APR. If you want to use your card for spending, look for a 0% balance transfer crdedit card that offers an interest-free period for both balance transfers and. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. Interest rate: 0% for 21 billing cycles on purchases and balance transfers, then % to % variable APR. Balance transfer fee: 3% ($5 minimum). Annual. Who's this card for: The Citi® Diamond Preferred® Card is a great option for those with good or excellent credit seeking a long introductory 0% APR period. Intro BT APR 0% intro APR for 18 months on Balance Transfers · Rewards Rate Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an. Which Capital One balance transfer credit card is best for you? ; PURCHASE RATE ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro. 10 partner offers ; Citi Double Cash Card · 0% for 18 months on Balance Transfers · % - % (Variable) ; Citi Rewards+ Card · 0% for 15 months on Purchases. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. One point of differentiation among balance transfer credit cards is the length of their introductory 0% APR period. Some cards have 0% periods of 18 months or. How to choose a 0% APR credit card. Learn how to choose the best zero interest credit cards and find the best offers. 6 min read Aug 16, Looking for best Balance transfer card with 0% APR · Wells Fargo Active Cash: Has a good $ sign up bonus after spending $ in first six. After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening. The 0% rate is usually valid for 12 or 18 months, sometimes more. Can you pay off the transferred balance during that period? If not, what interest rate kicks. Wells Fargo Reflect 0% APR on balance transfers (within days) AND purchases for 21 months. Balance transfer fee is high (mine is 5%) and. 0% intro APR for 18 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. With an introductory 0% APR balance transfer offer, you can move your debt from one credit card with high interest to a new card that has better terms and lower. Best 0% balance transfer cards ; Santander. - 26mths 0%. - 3% fee (min £5). - % rep APR · Apply* ; Virgin Money. - 20mths 0%. - 2% fee. - % rep APR. Check. After that the variable APR will be % – %, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening. Chase Freedom Unlimited® offers 0% intro APR on both purchases and balance transfers for the first 15 months after account opening. In addition, you'll earn.

Sky View Trading Review

Followers, Following, 64 Posts - Sky View Trading (@skyviewtrading) on Instagram: "We pioneer cutting-edge trading algorithms for futures. The platform combines essential resources and trading tools, making it an amazing resource comparable to services such as Motley Fool Options, Sky View Trading. Sky View Trading has the best options trading strategy that I've ever come across. Membership is well worth the money to learn how to trade options. Soren Sky View Trading located at Jumeirah,Trade Centre 1 is one of the Top Construction & Renovation in Dubai. Get Soren Sky View Trading reviews, ratings. Aerial imagery that gives you every detail. Nearmap proprietary cameras on planes give you a more up-to-date aerial view of your projects from multiple. Founded by Adam Thomas and Eli Grelecki, Sky View Trading is focused on spread-based strategies, and the stated goal is to rack up small but consistent profits. At Sky View Trading, we pioneer cutting-edge trading algorithms for options, futures, and stocks. Our precision-focused strategies unlock hidden potential. Sky View Trading is an online options education and trade signal alerts service with some interesting tools. Are they right for you? Read our review now. At Sky View Trading, we employ cutting-edge algorithms that eliminate emotional biases, allowing for precise execution even in volatile markets. Followers, Following, 64 Posts - Sky View Trading (@skyviewtrading) on Instagram: "We pioneer cutting-edge trading algorithms for futures. The platform combines essential resources and trading tools, making it an amazing resource comparable to services such as Motley Fool Options, Sky View Trading. Sky View Trading has the best options trading strategy that I've ever come across. Membership is well worth the money to learn how to trade options. Soren Sky View Trading located at Jumeirah,Trade Centre 1 is one of the Top Construction & Renovation in Dubai. Get Soren Sky View Trading reviews, ratings. Aerial imagery that gives you every detail. Nearmap proprietary cameras on planes give you a more up-to-date aerial view of your projects from multiple. Founded by Adam Thomas and Eli Grelecki, Sky View Trading is focused on spread-based strategies, and the stated goal is to rack up small but consistent profits. At Sky View Trading, we pioneer cutting-edge trading algorithms for options, futures, and stocks. Our precision-focused strategies unlock hidden potential. Sky View Trading is an online options education and trade signal alerts service with some interesting tools. Are they right for you? Read our review now. At Sky View Trading, we employ cutting-edge algorithms that eliminate emotional biases, allowing for precise execution even in volatile markets.

Find & Download the most popular Sky View Trading Review Photos on Freepik ✓ Free for commercial use ✓ High Quality Images ✓ Over 54 Million Stock Photos. As someone new to trading, finding reliable resources to guide me through the complexities of the market has been crucial. I recently came across Skyview. more resources · Self-help. Self-help. Reader Reviews. Be the First to Write a Review. Professional Reviews. Awards. Book Profile. About the Author. View Author. Write your Review. Title. Maximum 30 characters. Rate this business. - Select a value -, 1, 2, 3, 4, 5. Your Review. Customer Code. Source. - None -, Website. Sky View Trading is a little bit scammy and fraudulent because they don't produce any content. Like I've never seen any of the two guys (Eli Grelecki and Adam. Sky View Trading - Youtube Channel spacequest-time.ru Subscribe Email ****@spacequest-time.ru YouTube Subscribers KType Micro Frequency 3 videos. These reviews are the subjective opinions of Tripadvisor members and not of Tripadvisor LLC. Tripadvisor performs checks on reviews as part of our industry-. Sky View Trading · Investment Performance · Quality Of Writing/Analysis · Value For Price · Customer Service. Chemical equipment Soren Sky View Trading at Grosvenor House Soren Sky View Trading. Chemical equipment. No reviews yet. Write review. Directions. Sky View Trading located at Deira,Al Buteen is one of the Top Distributors & Wholesalers in Dubai. Get Sky View Trading reviews, ratings, contact address. BBB accredited since 7/7/ Financial Consultants in Kirkland, WA. See BBB rating, reviews, complaints, get a quote & more. Sky View Trading, Seattle, Washington. likes. We pioneer cutting-edge trading algorithms for futures, options, and stocks. Our precision-focused. 4 videosLast updated on Dec 1, Play all · Shuffle · · sky view trading review My Real Experience | PART 1. Karl Domm - REAL P&L Trading. On top of that, Sky View Trading also maintains a trader chatroom and forum, allowing you to easily communicate with other options traders and learn from them. The review of spacequest-time.ru is positive. The positive trust score is based on an automated analysis of 40 different data sources we checked online such as. Do you agree with Sky View Trading's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out. What Is Sky View Trading? Sky View Trading is an options trading reviews and ratings and viewing customer experiences with it. Step. What does that mean for the future of our species? an aerial view of Mountain Pass rare earth mine and processing facility · Climate change and energy · This. I've been using Sky view trading for a while now and I can say that they are one of the best in the business. Their trading strategies are effective and their. What would you say about your employer? Help fellow job seekers by sharing your unique experience. Write a review. Questions and answers.