spacequest-time.ru

Tools

How To Mentally Discipline Yourself

Meditation is a very powerful tool, that can help you improve your mental, physical, and emotional health. Sitting for while keeping your mind still and. Am I setting myself goals for what I want to accomplish each day? · Do I take breaks throughout the day? · Have I taken steps to limit the distractions and. Seeing self-discipline in terms of pure willpower fails because beating ourselves up for not trying hard enough doesn't work. In fact, it backfires. Maybe by being strict with yourself? By shaming or mentally beating yourself up until you give in? Or maybe even to focus on all the bad things you'll suffer if. Mental discipline isn't about motivating yourself excitedly once a month about what you hope to do. It is about making a daily, committed decision as to what. Self-discipline revers to one's ability to control one's behavior and actions to achieve a goal or to maintain a certain standard of conduct. It is the ability. Result: Self-Discipline Without Willpower Once you resolve much of your shame, and once you've created situations to provide greater emotional benefits from. Discipline Yourself: Develop Habits and Systems to Boost Mental Toughness, Conquer Self-Sabotaging Behavior and Finish What You Start: The Key to Getting. You need to develop skills by learning and training yourself to practice self-control until self-discipline becomes a habit. Follow these seven steps to success. Meditation is a very powerful tool, that can help you improve your mental, physical, and emotional health. Sitting for while keeping your mind still and. Am I setting myself goals for what I want to accomplish each day? · Do I take breaks throughout the day? · Have I taken steps to limit the distractions and. Seeing self-discipline in terms of pure willpower fails because beating ourselves up for not trying hard enough doesn't work. In fact, it backfires. Maybe by being strict with yourself? By shaming or mentally beating yourself up until you give in? Or maybe even to focus on all the bad things you'll suffer if. Mental discipline isn't about motivating yourself excitedly once a month about what you hope to do. It is about making a daily, committed decision as to what. Self-discipline revers to one's ability to control one's behavior and actions to achieve a goal or to maintain a certain standard of conduct. It is the ability. Result: Self-Discipline Without Willpower Once you resolve much of your shame, and once you've created situations to provide greater emotional benefits from. Discipline Yourself: Develop Habits and Systems to Boost Mental Toughness, Conquer Self-Sabotaging Behavior and Finish What You Start: The Key to Getting. You need to develop skills by learning and training yourself to practice self-control until self-discipline becomes a habit. Follow these seven steps to success.

A self-disciplined person is someone who consistently chooses the actions, routines and habits that will help them reach an important long-term goal. Self-discipline also means taking care of yourself, both physically and mentally. Therefore, practice self-care habits that support your well-. Here are 3 keys to developing self-discipline: · 1. Imagine your ideal self. This is the highest version of yourself. · 2. Describe and envision the behaviors and. It's about you creating your own rules that you want to follow for yourself so that you can create the life that you want to live, so that you can reach your. To discipline yourself, start by identifying and visualizing your end goal. Next, create a plan on paper with actionable steps that you can follow. Then, choose. The will is the mental faculty that gives you the ability to hold one idea on the screen of the mind, to the exclusion of all outside distractions or ideas. Discipline Yourself: Develop Habits and Systems to Boost Mental Toug - VERY GOOD Be the first towrite a review. Discipline Yourself: Develop Habits and Systems to Boost Mental Toughness, Conquer Self-Sabotaging Behavior and Finish What You Start: The Key to Getting. Seek to convince yourself that you want to learn discipline for the purpose of believing in yourself. This is especially important if you spend a lot of time. Your own drive as the basis for self-discipline · Time restrictions and priorities as a framework for your goal · Use your personal rhythm to work on yourself in. Self discipline is something that many people need to work on. It is all about learning to control yourself and make good decisions. Self-discipline revers to one's ability to control one's behavior and actions to achieve a goal or to maintain a certain standard of conduct. It is the ability. Mindfulness and meditation are already acts of self-discipline because showing up to sit with the mind regularly strengthens our sense of commitment. Meditation. Meditation is a very powerful tool, that can help you improve your mental, physical, and emotional health. Sitting for while keeping your mind still and. Self-discipline is broadly defined as conscious control that is oriented towards successful outcomes by overcoming obstacles or impediments. A self-disciplined person is someone who consistently chooses the actions, routines and habits that will help them reach an important long-term goal. On the surface, it might be said that self-discipline is about finding compelling reasons to do something then committing yourself to see things through to the. Discipline Yourself: Develop Mental Toughness, Strengthen Your Willpower, Build Habits to Overcome Procrastination, and Finish What You Start: The Key to. Self-discipline is the ability to control one's feelings and overcome one's weaknesses. In other words, with discipline, you can go in any area. No Excuses!: The Power of Self-Discipline.

Should I Refinance My Car Through The Dealership Or Bank

When you go through a dealership or online retailer, you can fill out an application to organize financing in the same place that you buy the car. If you go. Can I refinance my vehicle with Chase? opens in the footnote target To finance a new or used car with your dealer through JPMorgan Chase Bank, N.A. Dealer financing may well turn out to be a great option for you if you have perfect credit and know that you can afford the car payment. Check your credit score: Paying your bills on time will lead to a higher credit score and means you can get the perks of refinancing. · Start applying: · Evaluate. Refinance Your Ride. See if you could save on your monthly payment. Love your car, but want to trade in your interest rate? If your loan. The new lender you choose will need to see the title to do a refinance. Waiting longer, such as six months to a year, will give your credit score a chance to. This is why it pays to shop for financing before going to the dealer. The dealer should try to beat the best rate you got on your own - not offer you the loan. Carefully review refinancing options if you can't avoid a dealer loan. Consider refinancing the auto loan through your credit union or other lender as soon as. Scenario: You financed your vehicle through an honest dealer or a bank with a great reputation. When you took out the loan, you were certain you were. When you go through a dealership or online retailer, you can fill out an application to organize financing in the same place that you buy the car. If you go. Can I refinance my vehicle with Chase? opens in the footnote target To finance a new or used car with your dealer through JPMorgan Chase Bank, N.A. Dealer financing may well turn out to be a great option for you if you have perfect credit and know that you can afford the car payment. Check your credit score: Paying your bills on time will lead to a higher credit score and means you can get the perks of refinancing. · Start applying: · Evaluate. Refinance Your Ride. See if you could save on your monthly payment. Love your car, but want to trade in your interest rate? If your loan. The new lender you choose will need to see the title to do a refinance. Waiting longer, such as six months to a year, will give your credit score a chance to. This is why it pays to shop for financing before going to the dealer. The dealer should try to beat the best rate you got on your own - not offer you the loan. Carefully review refinancing options if you can't avoid a dealer loan. Consider refinancing the auto loan through your credit union or other lender as soon as. Scenario: You financed your vehicle through an honest dealer or a bank with a great reputation. When you took out the loan, you were certain you were.

You can refi with a bank or CU. Make sure you are looking at used rates and not new.

Pay stubs or bank statements to verify your income and/or employment · Insurance, lease agreement or mortgage statement to verify your residence · Vehicle title. Pay stubs or bank statements to verify your income and/or employment · Insurance, lease agreement or mortgage statement to verify your residence · Vehicle title. The interest rate offered will go up if your score is lower. If your score is low, the dealership will require more money up front and charge a higher interest. Bank of America is not affiliated with these dealerships and does not require any particular dealership for your vehicle buying experience. Consequently, Bank. Refinancing may allow you to extend your loan's financing term by years to reduce your monthly burden. By extending the loan term, you end up spreading the. In the fourth quarter of , credit unions won the market share of all automotive loans and leases—more than banks and dealerships combined. If this is the case, refinancing will most likely save you money through lower interest rates. However, if you're not quite ready to refinance because of credit. So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. Refinancing could help you keep your vehicle but lower your payment to better fit your monthly budget. Pay your loan off sooner. Your monthly payment may. If you find you owe more than your car is worth, you most likely can't refinance until you get into a positive equity position. The best way to do this is to. Car Loan Calculator. See how your interest rate, down payment amount and financing term could affect your loan payment. Type. Many lenders charge higher rates on older vehicles, starting anywhere from years old. If your car is older, you may be surprised the interest rate you. vehicle and are usually financed through a bank, credit union or other lender. You may also be able to go through a car dealership your payments. If you. Featured article. If you're asking yourself, "Should I refinance my car loan?", consider these factors to help you decide. No impact to your credit score to see if you pre-qualify. Refinance your car with an easy online process and see if you could save monthly or overall. Talking to your lender could save you hours of research, time spent filling out applications and the stress of negotiating terms with other banks. 2. Showing Up. This is why it pays to shop for financing before going to the dealer. The dealer should try to beat the best rate you got on your own - not offer you the loan. It's generally best to refinance your car loan when market rates are low and you can qualify for lower monthly payments or better terms. When you should. You can only refinance your vehicle with Ally if your current financing is through another lender, and if your vehicle isn't financed in Nevada, Vermont, or the.

How Do Staffing Agencies Work

How Staffing Agencies Work · Filling senior level management positions · Finding candidates to fill positions that are temporarily vacant · Filling temp-to-perm. Staffing agencies work as intermediaries between companies and job seekers. They specialize in finding qualified skilled candidates to fill temporary or long-. I worked for a temp agency for a year and the company I worked at hired me. Good experience but looking back they made a great deal of money off of me. Using a staffing agency eliminates upfront costs used to market, find and attract talent, they also reduce employer's overhead by eliminating benefits costs. Benefits of Working With A Staffing Agency · Gain access to a larger pool of candidates · Speed up your hiring process. How Do Las Vegas Staffing Agencies Work? Staffing, or employment, agencies fill open positions for the employers they contract with. The agency is paid by the. Typically, a staffing agency can tap into their candidate database find you temporary employees quickly. The agency will also handle things like payroll. Rather than focusing on finding jobs for individuals, IT staffing companies typically strive to find employees for different businesses. Further, staffing. How do staffing agencies work? · Employers contact staffing agencies · Candidates apply for open roles · Candidates are screened · Staffing agencies handle. How Staffing Agencies Work · Filling senior level management positions · Finding candidates to fill positions that are temporarily vacant · Filling temp-to-perm. Staffing agencies work as intermediaries between companies and job seekers. They specialize in finding qualified skilled candidates to fill temporary or long-. I worked for a temp agency for a year and the company I worked at hired me. Good experience but looking back they made a great deal of money off of me. Using a staffing agency eliminates upfront costs used to market, find and attract talent, they also reduce employer's overhead by eliminating benefits costs. Benefits of Working With A Staffing Agency · Gain access to a larger pool of candidates · Speed up your hiring process. How Do Las Vegas Staffing Agencies Work? Staffing, or employment, agencies fill open positions for the employers they contract with. The agency is paid by the. Typically, a staffing agency can tap into their candidate database find you temporary employees quickly. The agency will also handle things like payroll. Rather than focusing on finding jobs for individuals, IT staffing companies typically strive to find employees for different businesses. Further, staffing. How do staffing agencies work? · Employers contact staffing agencies · Candidates apply for open roles · Candidates are screened · Staffing agencies handle.

Staffing agencies provide skilled employees to work on a temporary or contract basis. Some employers also use staffing agencies as recruiters in positions known. Normann Staffing is a leading recruitment agency in the Hudson Valley that matches passionate job seekers with the region's top companies. Staffing agencies help job seekers get noticed and land positions that match their qualifications at companies that are hiring. How do Staffing Agencies Work? Staffing agencies typically work by first building a pool of job candidates by recruiting and screening potential workers. Job. 1. The employer makes initial contact. · 2. The staffing agency assesses its portfolio. · 3. Candidates apply for work through the staffing agency. · 4. The agency. A permanent staffing agency like Apex Staffing in Central Arkansas makes connections between its employer clients and job candidates to fill temp-to-hire or. Staffing agencies operate within the business services industry and work with organizations of all shapes and sizes to find employees. These agencies help to. Volume of jobs to be filled by recruiting team is larger than can be accommodated at a given time; staffing agencies help as adjunct recruiting. Recruitment agencies are external firms that help companies fill open positions. They do this by handling the entire hiring process, from advertising the job to. A Staffing Agency, also known as a Temp Agency or Recruitment Firm, is a business that connects job seekers with employers and vice versa. A staffing agency is a business that connects companies with temporary, permanent, or contract employees. These agencies can work with different types of. A staffing agency is like having your own private human resource department. You simply give them the job description, the duties, the skills needed to fulfill. You save time. Finding jobs to apply to, customizing job search documents, and attending interviews takes time. Staffing agencies make the process easier. They. A staffing agency works as an intermediary between employers (client companies) and job seekers (candidates), providing services to match the right talent with. Staffing agencies typically recruit, screen, and hire job candidates to fill various roles in client companies, including temporary and full-time job positions. They draw upon their expertise in the job market and hiring process to identify the ideal candidates for hiring companies, creating successful employment. A healthcare staffing agency can handle all your hiring for you. They can even go as far as interviewing applicants, saving you even more time. Staffing agencies earn their profits from the companies they work with, not from the job candidates. If a staffing agency charges job candidates a fee, consider. A staffing agency helps employers and prospective employees find exactly what they're looking for – the right employee matched to the right job. A staffing agency is a company that provides employees to work in another company on a temporary or permanent basis.

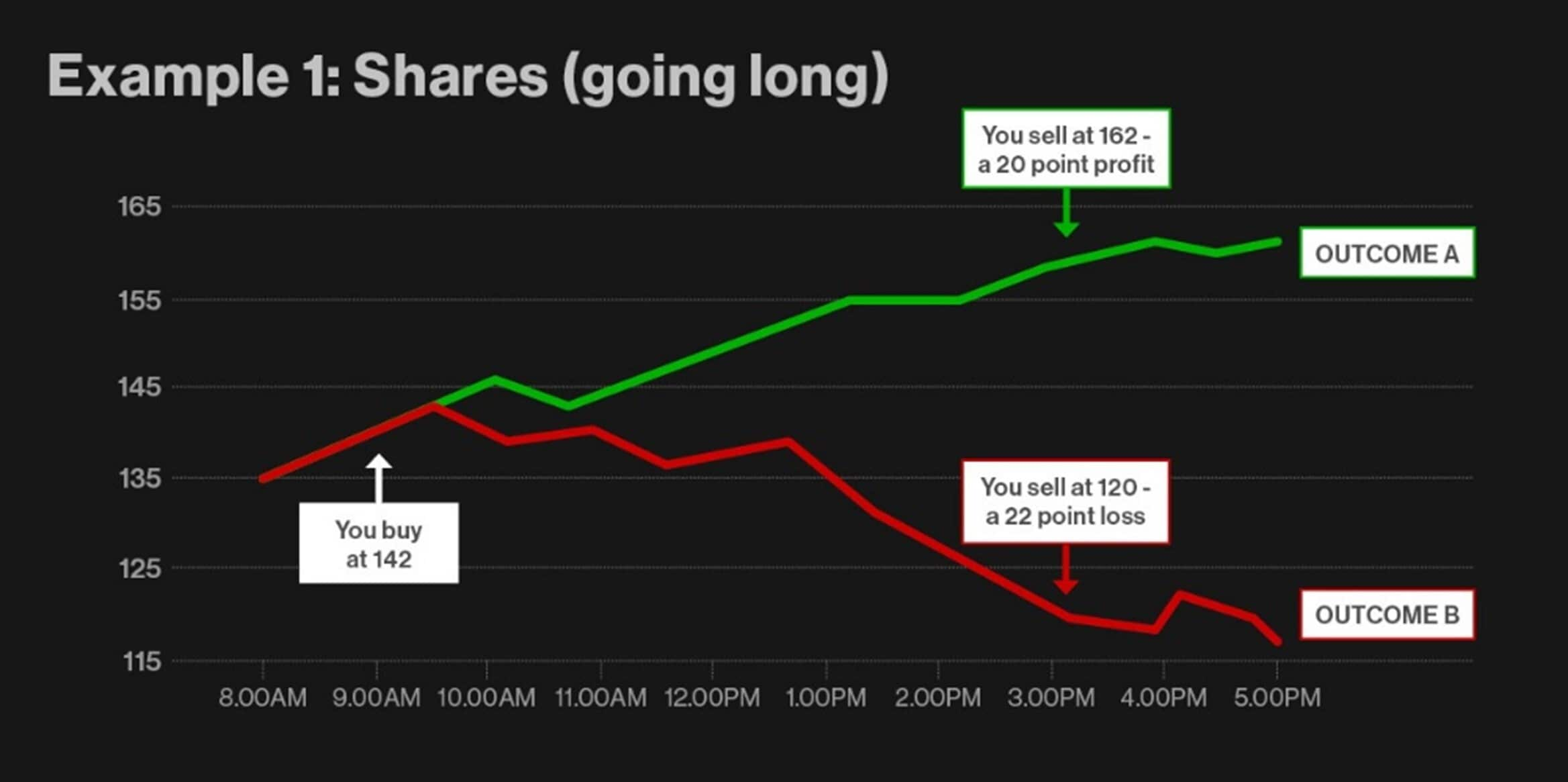

Spread Betting Brokers

Compare Broker is the fastest way to compare + of the best regulated online trading brokers, so that you can find a reputable and affordable broker faster. In our spread betting broker comparison, we assess key criteria, such as fees, support and trading offers, and explain what to look for when selecting. Brokers offer spread betting primarily for its tax efficiency, especially in regions like the UK where spread betting profits are typically not subject to tax. Financial spread betting is a form of trading where individuals can profit from price movements in various financial markets without owning the underlying. spread betting brokers-Our online store has a wide range of fashion accessories for you to choose from to enhance your style. Whether it's delicate earrings or. Because spread betting is so highly leveraged, you can start betting with just a small amount of capital. Therefore, many financial spread betting brokers only. A spread betting broker is a company regulated by the Financial Conduct Authority (FCA) to provide financial services like spread betting to retail (and. Spread Betting Companies · Accendo Markets · CMC Markets · IG Markets · Hantec Markets · ETX Capital · SpreadEx · AVATrade · Spreadco; FXPro; City Index. Spread. To address the needs of UK brokers and their clients, cTrader supports multi-asset-class spread betting. It is available as a competitively-priced add-on to. Compare Broker is the fastest way to compare + of the best regulated online trading brokers, so that you can find a reputable and affordable broker faster. In our spread betting broker comparison, we assess key criteria, such as fees, support and trading offers, and explain what to look for when selecting. Brokers offer spread betting primarily for its tax efficiency, especially in regions like the UK where spread betting profits are typically not subject to tax. Financial spread betting is a form of trading where individuals can profit from price movements in various financial markets without owning the underlying. spread betting brokers-Our online store has a wide range of fashion accessories for you to choose from to enhance your style. Whether it's delicate earrings or. Because spread betting is so highly leveraged, you can start betting with just a small amount of capital. Therefore, many financial spread betting brokers only. A spread betting broker is a company regulated by the Financial Conduct Authority (FCA) to provide financial services like spread betting to retail (and. Spread Betting Companies · Accendo Markets · CMC Markets · IG Markets · Hantec Markets · ETX Capital · SpreadEx · AVATrade · Spreadco; FXPro; City Index. Spread. To address the needs of UK brokers and their clients, cTrader supports multi-asset-class spread betting. It is available as a competitively-priced add-on to.

Other brokers offer variable spreads but with Trade Nation's low-cost fixed spreads, when the markets move, your costs don't. It's no wonder we're the. It is a legitimate financial derivative. It's great for investors in the uk. Pepperstone, ig, ibkr all have the option to open spread betting. IG Markets tops the list as the leading spread betting broker in the UK because of its thousands of tradable market assets. Being a pioneer broker that was. Spread betting allows traders to speculate on the price movements of various financial instruments like Forex, stocks, and commodities, without owning the. For beginners, AvaTrade and Trade Nation are excellent spread betting platforms due to their intuitive interfaces, extensive educational resources, and. The best forex broker that provides spread betting on the MetaTrader 4 platform, look no further. Spread betting is tax free for the residents of the UK and. Between 64%% of retail investor accounts lose money when trading spread bets and CFDs with brokers. You should consider whether you understand how spread. IG Group is one of the most established spread betting brokers, offering a comprehensive range of markets and competitive spreads. Founded in , IG has. In reality, in most instances they are aggregating both sides, and taking the spread. Providing a marketplace, not setting the market. Spread Betting Forex Brokers. Here is a list of Forex brokers that offer spread betting trading services to their customers. Spread betting is a form of a. Enjoy tax-free profits by spread betting on your favourite markets including forex, commodities, and indices. Pepperstone offers spread betting through MT4, MT. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when. There are a number of spread betting companies available, each with their own proprietary platforms. However the provision to program the platforms based on. Compare some of the leading financial spread betting Companies. This is a list of some the top financial betting account providers to help you find the account. Spread betting is a form of financial speculation where individuals bet on the price movements of various assets without owning them. Spread betting allows traders to speculate on the price movements of various financial instruments like Forex, stocks, and commodities, without owning the. Spread Betting Brokers List · AB Forex Company · Accendo Markets · ActivTrades · Alpari · BARCLAYS Stockbrokers · BetOnMarkets · CANTOR Index · Capital Spreads. 10 Best UK Spread Betting Brokers and Platforms - Rated and Reviewed. An up-to-date Overview of the Best UK Brokers with Spread Betting. Trading platform for FX, CFD, and spread-betting brokers with direct integration with TradingView. Try DXtrade Now.

Isas Account

ISA stands for an Individual Savings Account. An ISA is an account that allows you to save and invest free from UK tax. Halifax offers two types of ISA. A Cash. ISA accounts provide tax-free allowance for saving and investing. Read on for more about what is ISA account. ISA stands for Individual Savings Account. The main difference between an ISA and any other savings account is that it offers tax-free interest payments. You may open multiple ISAs within a tax year just as long as they're not two of the same ISA – i.e. you not allowed to open two stock & shares ISAs in a single. They will most likely, refund the payments into the ISA and close or void the ISA. More guidance can be found here Individual Savings Accounts (ISAs) Thank. At Nationwide we offer several savings account and ISA options. Find out more and compare our latest range of savings accounts, fixed rate bonds and ISAs. Get tax free interest on savings of up to £ MoneySavingExpert compares the top paying cash ISAs to help you get the most from your savings. A cash ISA is a savings account where as your money grows you don't pay tax on the interest you earn. Individual Savings Accounts, ISAs for short, give you the opportunity to earn interest tax efficiently on your savings. You get an ISA allowance each tax year. ISA stands for an Individual Savings Account. An ISA is an account that allows you to save and invest free from UK tax. Halifax offers two types of ISA. A Cash. ISA accounts provide tax-free allowance for saving and investing. Read on for more about what is ISA account. ISA stands for Individual Savings Account. The main difference between an ISA and any other savings account is that it offers tax-free interest payments. You may open multiple ISAs within a tax year just as long as they're not two of the same ISA – i.e. you not allowed to open two stock & shares ISAs in a single. They will most likely, refund the payments into the ISA and close or void the ISA. More guidance can be found here Individual Savings Accounts (ISAs) Thank. At Nationwide we offer several savings account and ISA options. Find out more and compare our latest range of savings accounts, fixed rate bonds and ISAs. Get tax free interest on savings of up to £ MoneySavingExpert compares the top paying cash ISAs to help you get the most from your savings. A cash ISA is a savings account where as your money grows you don't pay tax on the interest you earn. Individual Savings Accounts, ISAs for short, give you the opportunity to earn interest tax efficiently on your savings. You get an ISA allowance each tax year.

We have a range of ISAs and savings accounts to suit you. Learn more about our ISAs, fixed term bonds and savings accounts and start comparing today. What is an ISA? ISA stands for Individual Savings Account, which is a tax-efficient way to grow your money. You don't pay income tax on your interest or. Cash ISAs. Make the most of tax-free savings; Grow your money with interest on your savings; Compare different types of accounts to suit. Multiple accountsInvest in one ISA or choose to spread your annual ISA allowance across one of each type. Even if you hold an account elsewhere, you can still. An individual savings account is a class of retail investment arrangement available to residents of the United Kingdom. First introduced in ISAs are a form of savings that has tax advantages. Income tax and capital gains tax can be saved if you invest in ISAs, but they are still counted in your. Cash ISAs (Individual Savings Accounts) pay interest free of Income Tax. Find out how they work, how to open one and if they are right for you. ISA stands for an Individual Savings Account. An ISA is an account that allows you to save and invest free from UK tax. Halifax offers two types of ISA. A Cash. Cash isas · A Cash ISA is a type of savings account that lets you earn tax-free interest on the money you save. · The total annual ISA allowance is £20, for. An ISA acts “like a bag you put your savings or investments inside to protect them from the taxman”, said The Times Money Mentor. Individual Savings Accounts (ISAs) allow you to hold savings and investments without paying tax on interest or capital gains. Learn more about ISAs here. ISAs are a tax-efficient way of saving money. You can save or invest up to a set amount (your ISA allowance) each tax year and you don't pay any tax on the. NatWest's Cash ISA interest rates · % / % AER / Tax free p.a. (variable) on balances of £1-£24, · % / % AER / Tax free p.a. (variable) on. Welcome to the FDOT - Internet Subscriber Account's home page. Internet Subscriber Accounts (ISA's) are used to access many of FDOT's external web applications. To open a new cash ISA, you need to be either: 18 years old or over, or; Covered by the transitional arrangements for those aged 16 or 17 (as of 5 April ). What is an ISA? ISA stands for Individual Savings Account. ISAs are a tax-efficient way of saving money. You can save or invest up to a set amount (your ISA. Individual savings accounts, or ISAs, let you save up to £20, each tax year without paying any tax on the interest you earn or on your investment returns. A cash ISA is similar to your ordinary savings account, the difference being you won't pay tax on any interest. So you can think of cash ISAs as tax-free. You can pay up to £20, into a cash ISA (Individual Savings Account) this tax year. For more information, read our guide to ISA allowances and Lifetime ISAs. An ISA (individual savings account) is a tax-free savings or investment account that allows you to put your ISA allowance to work and maximize the potential.

White Paper Writing

White Paper Writing Services. People are more likely to use your services if they trust your brand and a white paper written by a professional copywriter can. A white paper is an authoritative guide that discusses issues on a certain subject, along with a solution for handling the issues. The term came from. The first thing you need to do is read all you can about writing white papers from books, blogs, articles, etc. That also means studying examples so you know. The white paper is a marketing document that's become a staple for crypto projects. It is used by investors to determine whether a project has any merit. Or, you can simply use Word or Google Docs. Ready? Let's get this written! Step 1: Make the White Paper Count. First things first—if you're creating ad hoc. When writing a white paper, avoid giving them sales pitch vibes. White papers should be unbiased and educational, not a sales pitch. To achieve this, it is. A white paper is an authoritative, research-based document that presents information, expert analysis and an organization or author's insight into a topic. That White Paper Guy is award-winning B2B white paper writer Gordon Graham. Get white paper writing, planning and marketing tips, tactics, best practices. White Papers: The $1, Per Page Writing Project · 1. Influence Decision-Makers · 2. Generate Leads · 3. Support a Product Launch · 4. Stand Out from. White Paper Writing Services. People are more likely to use your services if they trust your brand and a white paper written by a professional copywriter can. A white paper is an authoritative guide that discusses issues on a certain subject, along with a solution for handling the issues. The term came from. The first thing you need to do is read all you can about writing white papers from books, blogs, articles, etc. That also means studying examples so you know. The white paper is a marketing document that's become a staple for crypto projects. It is used by investors to determine whether a project has any merit. Or, you can simply use Word or Google Docs. Ready? Let's get this written! Step 1: Make the White Paper Count. First things first—if you're creating ad hoc. When writing a white paper, avoid giving them sales pitch vibes. White papers should be unbiased and educational, not a sales pitch. To achieve this, it is. A white paper is an authoritative, research-based document that presents information, expert analysis and an organization or author's insight into a topic. That White Paper Guy is award-winning B2B white paper writer Gordon Graham. Get white paper writing, planning and marketing tips, tactics, best practices. White Papers: The $1, Per Page Writing Project · 1. Influence Decision-Makers · 2. Generate Leads · 3. Support a Product Launch · 4. Stand Out from.

Writing on white paper expands the freedom of expression. I rarely ever take notes or study on ruled paper. I have a decent enough. Steve Hoffman. Hoffman Marketing Communications, Inc. 1. Don't make the white paper too long (or too short). A four-page document. What you'll learn. How to write the first draft of a word white paper in a single day. A white paper can be an effective marketing tool for educating your audience about a particular topic helping readers make decisions and coming to a. Typically, the purpose of a white paper is to advocate that a certain position is the best way to go or that a certain solution is best for a particular problem. The white paper format will be familiar to most readers, with a table of contents, executive summary of key takeaways, methodology, short sections, and — all. A white paper needs to provide readers with general background information of a particular issue in order to help them make their decision based on the. Course Highlights · Learn the best practices for writing white papers that have impact · Actually write a white paper to receive coaching from your instructor. Problem/solution. This kind of white paper is very straightforward: you outline a particular problem, then recommend a solution. · Summary list. In this format. A problem/solution white paper describes a nagging industry problem, all the existing solutions and their drawbacks, and then a new, improved approach that. The best thing is to advertise your services as a white paper writer through your website, cold calling, and other marketing methods. Look for companies that. A white paper helps your business generate leads, and ultimately make sales, by helping your target customers get informed about an issue that matters to their. 8 Simple Steps for Writing an Amazing White Paper · 1. Choose a Valuable Topic · 2. Determine Your Audience · 3. Come Up with an Enticing Headline · 4. Write. To write a white paper, start with an introduction summarizing a problem you're dealing with, then how you propose to solve that problem. Detail possible. Unlike proposals, which include more extensive information, white papers offer a brief overview of a research project in a way that explores why it would be. A white paper is an informational document issued by a company or not-for-profit organization to promote the features of a solution or product. Writing white papers A white paper is a long and detailed report that is usually created by experts. It provides readers with a comprehensive overview of a. In the world of policy, white papers guide decision makers with expert opinions, recommendations, and analytical research. Policy papers may also take the form. White papers begin with a short encapsulation of the subject matter, known as an executive summary. This summary should always contain the key takeaways and. A white paper is a report or guide that informs readers concisely about a complex issue and presents the issuing body's philosophy on the matter.

When Is The Cheapest Time To Buy Flight Tickets

To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. We've loads of clever tricks to help you find cheap holiday destinations, book flights at the right time and more. a cheap flight booking. Niche travel. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Popular Flight Deals on Spirit *One-way fares displayed above have been collected within the last 48 hours and may no longer be available at the time of. Flight deals from Delta let you travel the world on a budget. Take advantage of these airfare discounts and book cheap plane tickets today at spacequest-time.ru To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a few months in advance for international travel. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. Flights go on sale 11 months before departure, but don't expect to catch any airline deals more than days prior to takeoff. The best time to buy flights is usually weeks in advance for domestic and months for international. Prices often rise closer to. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. We've loads of clever tricks to help you find cheap holiday destinations, book flights at the right time and more. a cheap flight booking. Niche travel. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Popular Flight Deals on Spirit *One-way fares displayed above have been collected within the last 48 hours and may no longer be available at the time of. Flight deals from Delta let you travel the world on a budget. Take advantage of these airfare discounts and book cheap plane tickets today at spacequest-time.ru To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a few months in advance for international travel. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. Flights go on sale 11 months before departure, but don't expect to catch any airline deals more than days prior to takeoff. The best time to buy flights is usually weeks in advance for domestic and months for international. Prices often rise closer to.

You must have already heard that it is best to buy a flight ticket three months before your trip, or at least three weeks before. Average ticket prices tend. Domestic airfare in spring: 90 days ahead. But that's not the end the story! Now we're going to introduce you to a bunch of additional tools. Using the lesser-. Reserve your international flights among more than Air France destinations worldwide. Find offers from Air France USA and flight schedules. Hopper's stats have shown that the cheapest day to depart for Florida is a Tuesday, while Wednesday is the cheapest day to return — saving as much as $35 and $. Tuesdays and Wednesdays are often the best days to find deals, and flying on weekdays can also be cheaper than weekends. Additionally, using. Tuesday, Wednesday and Saturday are often cheap days to fly. Search using the calendar on spacequest-time.ru to see flight prices on individual days and pick the one. Generally, flight prices are more likely to increase the closer you get to your flight date. What is a flexible ticket? A flexible ticket allows you to change. When is the best time to book flights? For each flight and airline price patterns are different. Generally the earlier you buy plane tickets, the higher. Traveling to Hawaii during the Islands' “shoulder” months of April, May, September and October means you may find more affordable deals and less crowded beaches. You'll get a good deal if you don't buy tickets the minute they come available or within a month of your trip. Do Flight Prices Go Down on Tuesday? The myth has. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. Those planning a trip during a peak period, such as midsummer, Christmas or New Year's should start looking for domestic flights two to five months in advance –. Flights go on sale 11 months before departure, but don't expect to catch any airline deals more than days prior to takeoff. "You can typically book flights up to 12 months in advance, but those aren't the best fares." When is the best time to book a flight? Keyes recommends booking. The cheapest month for flights to New York is April, where tickets cost $ on average for one-way. Save money on airfare by searching for cheap flight tickets on KAYAK. KAYAK searches for flight deals on hundreds of airline tickets sites to help you find the. Unlike domestic flights where purchasing far in advance is often the best way to get a cheap flight we've noticed that sometimes prices start high for six month. Find cheap flights and save money on airline tickets to every destination in the world at spacequest-time.ru Whether you already know where and when you want. Aim to book your flight about days before you travel to take advantage of lower prices. But once again, the optimum booking period depends on your. Based on 20global flight data for Economy tickets, prices usually start to increase 56 days before departure for domestic flights. When traveling.

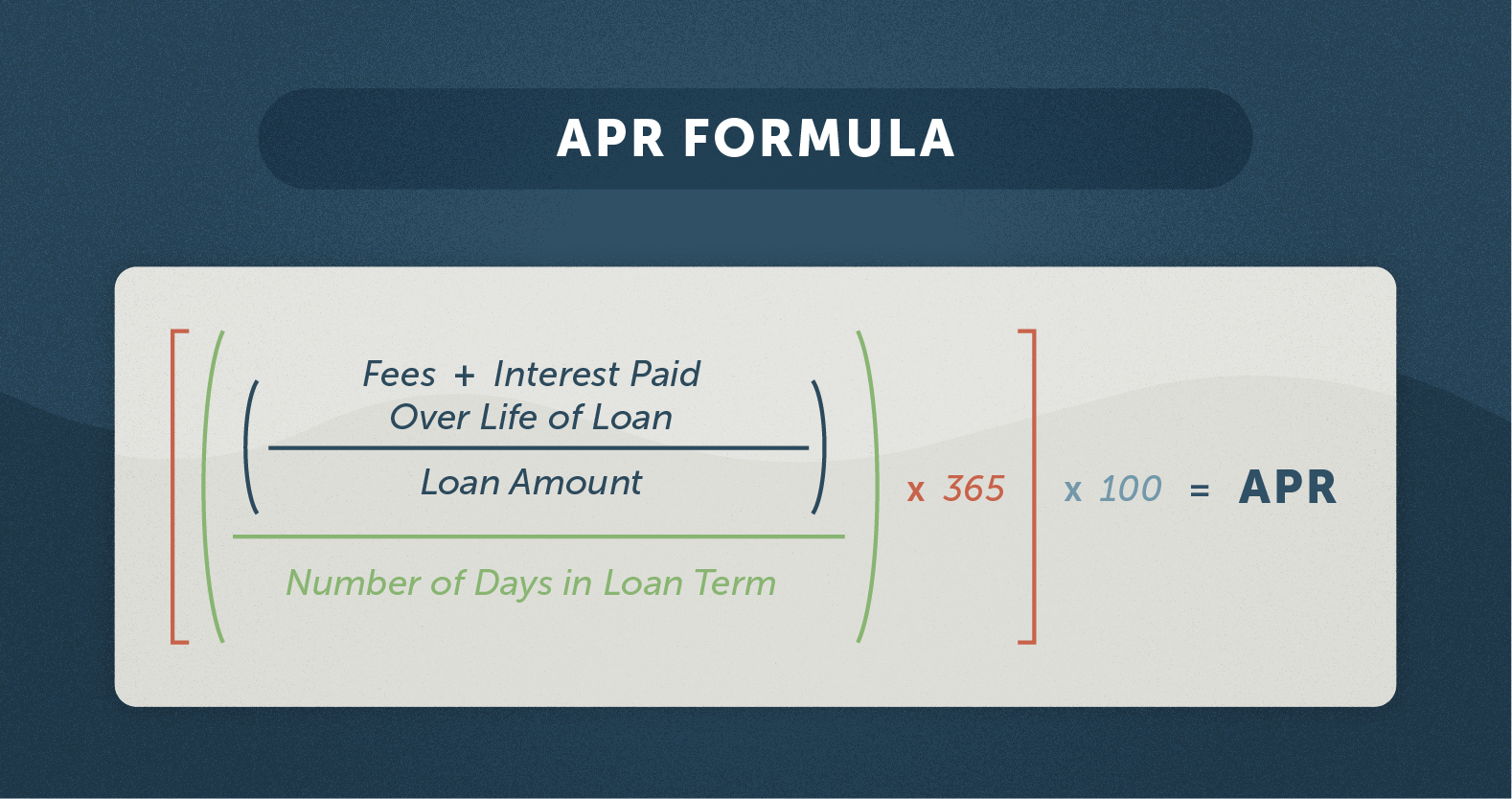

What Are Apr Fees

While the interest rate determines the cost of borrowing money, the annual percentage rate (APR) is a more accurate picture of total borrowing cost because it. The difference between an interest rate and the APR is as follows: Because the APR includes additional costs, it is typically higher than your interest rate. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate. Primary tabs. An annual percentage rate (APR) is the yearly rate charged for a loan or earned by an investment. In other words, it is a measure of the cost of. Although other charges, like late payment fees and cash withdrawal charges are not included. APR is a way of measuring the yearly all-in cost of credit. As an. The interest rate on a loan determines how much interest you'll pay, but it doesn't account for fees and other charges that you also owe. The APR is an all-inclusive, annualized cost indicator of a loan. It includes interest as well as fees and other charges that borrowers will have to pay. An APR is the interest rate you are charged for borrowing money. In the case of credit cards, you don't get charged interest if you pay off your balance on. The nominal APR is the simple-interest rate (for a year). · The effective APR is the fee+compound interest rate (calculated across a year). While the interest rate determines the cost of borrowing money, the annual percentage rate (APR) is a more accurate picture of total borrowing cost because it. The difference between an interest rate and the APR is as follows: Because the APR includes additional costs, it is typically higher than your interest rate. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate. Primary tabs. An annual percentage rate (APR) is the yearly rate charged for a loan or earned by an investment. In other words, it is a measure of the cost of. Although other charges, like late payment fees and cash withdrawal charges are not included. APR is a way of measuring the yearly all-in cost of credit. As an. The interest rate on a loan determines how much interest you'll pay, but it doesn't account for fees and other charges that you also owe. The APR is an all-inclusive, annualized cost indicator of a loan. It includes interest as well as fees and other charges that borrowers will have to pay. An APR is the interest rate you are charged for borrowing money. In the case of credit cards, you don't get charged interest if you pay off your balance on. The nominal APR is the simple-interest rate (for a year). · The effective APR is the fee+compound interest rate (calculated across a year).

Title fee. Amortization Schedule Fee. YES. YES. YES. YES. Annual Assessments. NO. NO. NO. NO. Taxes. Annual Fee. NO. NO. NO. NO. Not a finance. A common way you may incur APR charges is by only making the minimum payment on your credit card, thus carrying a balance past the due date. Interest rate. APR means Annual Percentage Rate. It's the cost of borrowing money over a year on a credit card or loan. It takes into account interest, as well as other. Annual Percentage Rate: The annual percentage rate or APR is disclosed to you when you open the account and is noted on each bill you receive. It is a measure. Fees Included in APR Finance Charges: K Permits; K Consultant Fee; K Inspection Fee (Lender Makes These Inspections); K Supplemental Document. The APR encapsulates the comprehensive annual cost of a loan, incorporating fees and additional expenses, also depicted as a percentage. The total annual cost of your loan, including interest rate and origination fee, and the true cost of borrowing money. Use APR to compare loan costs across. The APR expresses the total cost of borrowing which may differ among lenders based on how they set their rates, and the fees they charge. Your credit score and. A quick summary · APR gives you an estimate of how much borrowing money on a credit card will cost. · In fact, it includes interest rates and all standard fees. Lender fees must be included in the APR when they are paid by a home seller. The borrower pays the fees indirectly in the house price. Real APR: % The APR is an all-inclusive, annualized cost indicator of a loan. It includes interest as well as fees and other charges that borrowers will. Annual percentage rate (APR) is the annual cost of borrowing money, including fees. Learn more about how to calculate it, different types of APR and more. Below, you will find steps and formulas for calculating both your daily and monthly percentage rates, which are based on your APR, and how they are applied to. It represents the price to borrow money. It's expressed as a yearly percentage that includes the loan's interest rate plus additional costs, such as lender fees. The calculation of APR incorporates the nominal interest rate, any fees or additional costs, and the loan term. This amalgamation provides a clearer picture of. APR represents the annual cost of borrowing money, shown as a percentage. · APRs may be higher than interest rates because they include the interest rate plus. APR – or Annual Percentage Rate – refers to the total cost of your borrowing for a year. Importantly, it includes the standard fees and interest you'll have to. It is designed to help borrowers compare different loan options. For example, a loan with a lower stated interest rate may be a bad value if its fees are too. The interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card. These fees are called “prepaid finance charges” and may vary widely between lenders, so watch for them. One good example of a prepaid finance charge is an “.

Zero Cost Home Equity Line Of Credit

A Home Equity Line of Credit (HELOC), like the TD Home Equity FlexLine, allows you to use the equity in your home to pay for something big (like renovations). Create your dreams in Central Ohio. Make ends meet. · % APR introductory rate for 90 days, followed by low everyday rates for the remainder of the term · No. Receive % off your interest rate for the life of your loan when you sign up for auto pay on a new HELOC application. ** That's double our regular discount. Loan features reduced interest rate and no origination fees. Available on existing primary residence and loans up to $, First or second lien only. Loan. Take out a new home equity line of credit (HELOC) and get 3 months** of 0% intro APR1 (as low as % APR* thereafter) if you're borrowing up to $, Our Home Equity Line of Credit offers flexibility, and you'll pay zero closing costs. If you expect to have ongoing expenses, this option is for you. Borrow. No-closing-cost home equity loans offer an attractive option for homeowners looking to leverage their property's equity without the burden of upfront fees. Home equity line of credit · You can take out small sums periodically, as opposed to one lump sum · Interest will only be charged when you deduct the money · Zero. A HELOC is handy when your expenses are unpredictable. You can use all or just a portion of your approved limit and there's no cost when you aren't using it. A Home Equity Line of Credit (HELOC), like the TD Home Equity FlexLine, allows you to use the equity in your home to pay for something big (like renovations). Create your dreams in Central Ohio. Make ends meet. · % APR introductory rate for 90 days, followed by low everyday rates for the remainder of the term · No. Receive % off your interest rate for the life of your loan when you sign up for auto pay on a new HELOC application. ** That's double our regular discount. Loan features reduced interest rate and no origination fees. Available on existing primary residence and loans up to $, First or second lien only. Loan. Take out a new home equity line of credit (HELOC) and get 3 months** of 0% intro APR1 (as low as % APR* thereafter) if you're borrowing up to $, Our Home Equity Line of Credit offers flexibility, and you'll pay zero closing costs. If you expect to have ongoing expenses, this option is for you. Borrow. No-closing-cost home equity loans offer an attractive option for homeowners looking to leverage their property's equity without the burden of upfront fees. Home equity line of credit · You can take out small sums periodically, as opposed to one lump sum · Interest will only be charged when you deduct the money · Zero. A HELOC is handy when your expenses are unpredictable. You can use all or just a portion of your approved limit and there's no cost when you aren't using it.

Shop for the best home equity line of credit interest rates by comparing offers from multiple HELOC lenders. → A HELOC is considered a second mortgage and uses your house as collateral if you fail to make the monthly payments. → HELOCs usually have lower rates than. Our Home Equity Line of Credit comes with low rates, zero closing costs*, no annual fees, and no application fees.*. Borrow up to 85% of your home's value. No application fees, no closing costs and no annual fee. There's no fee to apply, no closing costs (on lines of credit up to $1,,) and no annual fee. An RBC Homeline Plan combines a mortgage and home equity line of credit into one product. You can borrow up to 80% of the value of your home, and as you pay. The average rate on a home equity line of credit (HELOC) soared to percent as of Sept. 4, the biggest gain in five months, according to Bankrate's survey. At Space Coast Credit Union, our home equity lines of credit have no points, no loan origination fees, and no intangible tax. To learn more, we invite you. Get $10, to $, with $0 in closing costs* · No application fee. · Possible tax deductible interest payments. · Draw Term of months. · Loans up to 90% of. A home equity line of credit (HELOC) lets you borrow what you need, when you need it; you only pay interest on the money you withdraw within the first 10 years. Loan amounts from $10, to $, · Borrow up to % of your homes' equity · Low variable rates starting as low as prime · No minimum balance required. Up to 80% loan to value for qualifying customers. Minimum line amount $10, Variable rate calculated as Prime plus ZERO., current APR is %. Maximum. Get your personalized rate for a Home Equity Line of Credit up to $K with Take advantage of our low rates with no application fee or closing costs. No closing costs and no fee options available: Conditions apply. Appraisal fee will apply if loan amount is greater than $, or if required by the. HELOCs worth $, or less come with ZERO closing costs2. Apply Now. Man fixing a wall. Fixed-Rate Home Equity Line of Credit. Access cash over time. Enjoy. With a home equity line of credit (HELOC), you have the option to borrow up to an approved credit limit on an as-needed basis. In that regard, a HELOC functions. Pay no closing costs on a new Home Equity Line of Credit under $, and enjoy an intro rate as low as % APR for six months, and % to % APR. No closing cost options · Borrow as much as you need up to your credit limit · Lock in all or a portion of your line at a fixed rate · Rate discounts are available. HELOCs worth $, or less come with ZERO closing costs2. Apply Now. Man fixing a wall. Fixed-Rate Home Equity Line of Credit. Access cash over time. Enjoy. A home equity loan creates a second mortgage and may offer no-closing-cost options, while cash-out refinancing replaces your existing mortgage with a new one. Select your credit score to find the variable rate for your HELOC. Get your free credit score by signing in to your Ocean personal. online banking account.

Military Officer Without Degree

Officers can enter after they've completed a four-year college degree or can receive training through enlisted service. The lack of a college degree will not be an insurmountable road block for someone interested in becoming a police officer. Many law enforcement agencies. If you don't have a degree yet, the Green to Gold program is a way for enlisted Soldiers to earn a commission as an Army Officer after completing a bachelor's. A post-secondary degree and three years of experience working as an officer, or; Five years of peace officer experience, Meet the requirements for military. Quick Facts About Being A Military Officer · Commissioned officers must have a college degree. · Officer salaries are similar to the salaries of mid-level to. BECOME AN OFFICER · The Army Reserve Officer Training Corps (ROTC) prepares college students to become future officers. · Best of all, on graduation, those who. While most Officers possess a college degree, there is no degree requirement to become a Chief Warrant Officer or a Limited Duty Officer. These programs. Graduate college as an Officer with ROTC. · Graduate with a secure career as a commissioned Officer · Start at the rank of second lieutenant · Complete Officer. The Army offers the Green-to-Gold Non-Scholarship Program. This officer-path option is for Soldiers who have completed two years of college and who complete. Officers can enter after they've completed a four-year college degree or can receive training through enlisted service. The lack of a college degree will not be an insurmountable road block for someone interested in becoming a police officer. Many law enforcement agencies. If you don't have a degree yet, the Green to Gold program is a way for enlisted Soldiers to earn a commission as an Army Officer after completing a bachelor's. A post-secondary degree and three years of experience working as an officer, or; Five years of peace officer experience, Meet the requirements for military. Quick Facts About Being A Military Officer · Commissioned officers must have a college degree. · Officer salaries are similar to the salaries of mid-level to. BECOME AN OFFICER · The Army Reserve Officer Training Corps (ROTC) prepares college students to become future officers. · Best of all, on graduation, those who. While most Officers possess a college degree, there is no degree requirement to become a Chief Warrant Officer or a Limited Duty Officer. These programs. Graduate college as an Officer with ROTC. · Graduate with a secure career as a commissioned Officer · Start at the rank of second lieutenant · Complete Officer. The Army offers the Green-to-Gold Non-Scholarship Program. This officer-path option is for Soldiers who have completed two years of college and who complete.

Upon graduation, you will be commissioned as a second lieutenant in the Army and serve for five years on Active Duty. DIRECT COMMISSION This commission is based. OCC is a week commissioning program in Quantico, VA for college seniors and graduates interested in earning the title as a United States Marine Officer. Upon. Military Experience, Police Officers also display characteristic favourable degree is nice but not an absolute requirement. I would like to know if. without completing a baccalaureate degree. By the propensity for military service among military aged youth made the already tough task of officer. Those who want the traditional college experience can join the military after graduation as a commissioned officer through the ROTC program or OCS. Education and training · direct entry through the Royal Military College (RMC) in Duntroon, for people with or without a degree · a degree program through the. Earning a college degree marks a major achievement in your life. How you use that degree can determine your career success. When you become an Air Force officer. Commissioned officers typically enter the Military with a four-year college degree or greater and have completed officer training. Warrant officers are. For schools without fully-developed or drop-down degrees, contact the college point of contact to obtain the degree requirements. Soldiers will need an Army. It is also possible to become a warrant officer — a technical and tactical leader — without holding a four-year college degree. Warrant officer pay grades are. Learn to lead at Officer Candidate School (OCS). Put your college degree to use, gain leadership skills, and prepare for a career as an Army Officer. A male. officer's commission in the Canadian Armed Forces (CAF) and an undergraduate degree. without incurring any obligatory service or financial penalty. Quick Facts About Being A Military Officer · Commissioned officers must have a college degree. · Officer salaries are similar to the salaries of mid-level to. From coordinating communication across all military branches to defending satellites, each can make a global impact. And we're only evolving from here. Apply. You don't need to have a degree to become an Army officer – just good A levels, or equivalent. In fact you can even study for one while serving if you choose. In the United States Armed Forces, enlisted military personnel without a commissioned officers to possess a bachelor's degree prior to commissioning. Find out which degree is right for you · 1. Strategic Intelligence · 2. Criminal Justice · 3. Management Information Systems (MIS) · 4. Political Science · 5. Army Officer. The role. Role details. Ways to join. Next steps. You have a leader You'll have the opportunity to command soldiers in one of many military. degree from a recognized Canadian university, or a diploma from a military, or law enforcement organization; must not have any pending and/or. If your going to be an officer, then oviouslly you need a degree so it's a benieft. For enlisted, you'll enter as an E-3 with like 47 or more credits, E